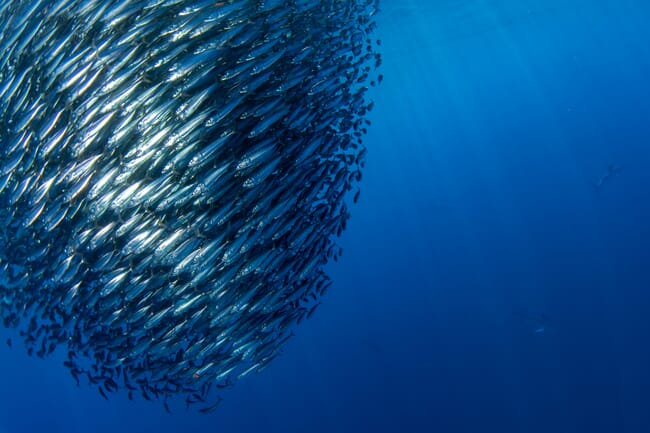

Harvesting fish for fishmeal and fish oil puts marine ecosystems under pressure

The salmon industry is exposed to major biodiversity risks through its reliance on fish meal and fish oil (FMFO) for fish feed. Fishing has an unparalleled effect on the biodiversity of the oceans, with a third of marine stocks now considered overfished. The WWF has reported that only 13 percent of the Earth’s vast network of oceans is still wilderness. Furthermore, 21 percent (2.1 million tonnes) of the total catch for FMFO purposes comes from poorly managed fisheries.

As a result of the inherent pressure that the sourcing of FMFO places on marine ecosystems, there is a drive within the aquaculture sector to diversify its feed basket, reducing reliance on FMFO and also increasing its resilience to supply chain shocks.

Based on FAIRR’s stakeholder engagement – which included investors, producers, feed producers, academics, community groups and NGOs – aquaculture companies must innovate and invest in alternatives to soy and FMFO now, to achieve the highly ambitious growth targets proposed across the salmon sector. Nonetheless, FAIRR has identified three major barriers to the adoption of alternative feed ingredients: scale, cost and conviction.

The FAIRR Initiative is encouraging the industry to invest in alternatives to soy and FMFO ingredients in aquafeed © CAT

Despite the acute need for alternatives, FAIRR’s research has shown there is little by way of a unanimous opinion within the sector, with different companies citing different suitability of the same alternative ingredients. Most debated its potential use is insect meal – an alternative protein source cited as having many sustainability benefits compared to traditional ingredients. Companies’ opinions ranged from placing it at the centre of their feed policy to the ingredient being unusable for salmon feed due to poor its nutritional profile. This lack of agreement sends the market a mixed signal regarding which technologies will have a customer base waiting for them if they are financed to scale.

One ingredient that was cited universally by companies as the potential alternative was algal oil, to be used as a fish oil replacement. However, the current price of this ingredient was cited as a clear barrier to increasing its uptake, as salmon feed has historically been purchased on a “lowest cost” basis.

Another group of potential alternative ingredients categorised under the term processed animal protein (PAP) was also cited as a means to reduce reliance on forage fish by some companies in FAIRR’s engagement. PAPs are sourced from the animal protein production sector as by-products and salmon farming companies based in Australia and Chile are permitted to – and do – utilise ingredients such as blood meal and poultry oil within their feed.

Although there is an argument for that this is a form of waste reduction and increased circularity there are also arguments against their use. Most concerning is that salmon producers who utilise these ingredients may be inheriting risks associated with the terrestrial meat-producing sector - a sector which salmon producers themselves have readily stated as being inferior in terms of sustainability. Salmon producers regularly cite the benefits of salmon compared to other animal proteins, so to then utilise these "less sustainable" proteins seems in some ways counterintuitive.

The rearing of an animal before slaughter carries environmental risks (eg deforestation and waste production/management) and social and governance risks (eg animal welfare, working conditions and antimicrobial resistance).

Although the recent change in EU regulation regarding the use of PAPs in animal feed may create an opportunity for salmon producers in this market, such as Norway, to utilise ingredients of this type, the industry must be conscious it is not inheriting all the risks it is working so hard to eliminate.

The aquaculture industry is exploring novel feed ingredients like insect meals, processed animal proteins and algal oils © Loch Duart

To reduce risk exposure, PAPs must be assessed as robustly as the virgin-sourced ingredients that contribute to the feed basket. The argument of circularity may be strong, but it cannot detract from the holistic assessments needed to ensure these products are produced and utilised in a sustainable way.

* The FAIRR Initiative has just released its Oceans and Biodiversity Impact Phase 2 report into its collaborative investor engagement on sustainable aquafeed – after a coalition of 75 investors, representing over USD 16 trillion in assets, met with eight of the world’s largest salmon producers to discuss the biodiversity and climate risks in their feed supply chains. This series presents the main findings and trends that emerged from Phase 2.