The report reveals that salmon production in Norway during 2023 was set to be very positive, but as the year developed the biomass didn’t pick up, and harvest weights remained low in Q3 and Q4 © Shutterstock

“It has a lot to do with the elasticity of the supply curves. Salmon has this inelastic supply curve and we’ve seen a massive demand uptick out of Covid, but the industry weren’t able to respond quickly, due to the length of the production cycle , meaning that prices remained high and have continued to do so, as they’re still not producing much more and demand is good,” Rabobank’s senior seafood analyst, Gorjan Nikolik, explains to The Fish Site.

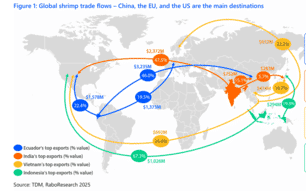

“On the other hand, in the case of shrimp, it’s really a buyers’ market from a structural perspective. The high price environment following Covid ignited a strong momentum in supply, in a supply curve that’s really responsive, leading to overproduction and they can’t seem to get out of that or rationalise. They’re producing more, driven by Ecuador, and so low prices have become the new normal – it’s testament to the fact that shrimp is both a young industry and an industry with a very elastic supply curve,” he adds.

It’s a pattern that has been apparent for at least 18 months and Nikolik warns that the trend is likely to continue for the foreseeable future. However, he adds, that there is still one market that might come to the rescue.

“I think that prices will improve when China restarts buying shrimp. Traditionally Chinese demand was growing by 7 to 9 percent a year and if we get good news that the inventory [the shrimp stockpiled by China after Covid restrictions were lifted] has been consumed and that Chinese consumer confidence is returning after Covid and all the real estate issues, then demand could be reignited, which could be a big help for shrimp prices,” he observes.

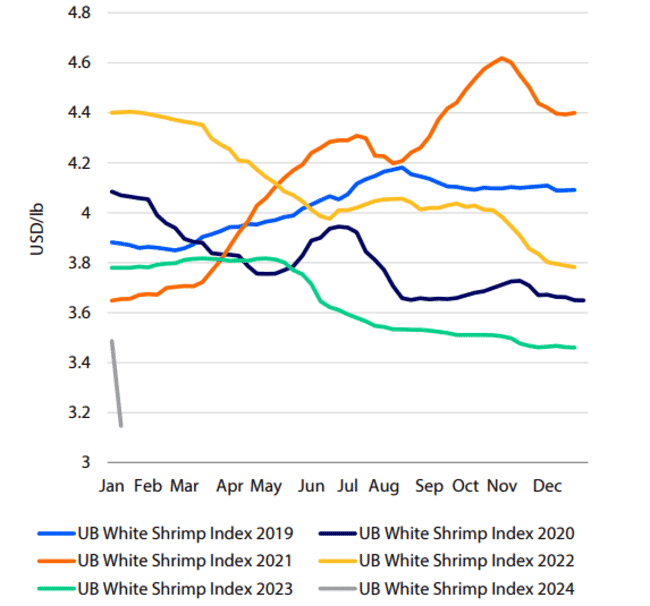

© Urner Barry and Rabobank

Political upheaval in Ecuador

Surprisingly, given the troubling headlines relating to political unrest and social instability in Ecuador, the current turmoil is yet to have had a major impact on the country’s shrimp sector.

“Security costs have been increasing for 2-3 years, and you can imagine the levels of M&A [mergers and acquisitions] will be greatly hindered. Some of the major shrimp players are interesting companies for global investors, and these outside investments could give a boost to capital availability and global reach in Ecuador. However, given the current political situation I don’t see big investors coming in. The recent transaction with Mitsui [which finalised a $360 million investment in Santa Priscilla in November 2023] took five years to complete and in the current environment it probably wouldn’t have occurred,” Nikolik reflects.

“It’s preventing Ecuador from receiving strategic capital and there has been some increase in the costs of production too, but Ecuador is still the global leader when it comes to low-cost production,” he adds.

Despite Ecuador’s success in keeping the costs of production down, Nikolik is fairly certain that even the most efficient producers in this most efficient shrimp producing companies is still making a loss. However, he adds that running at a loss is likely to be preferable, at least in the short term, to mothballing operations or dramatically decreasing production.

“It might be that it’s still worth producing as shutting down operations would make an even bigger loss,” he explains.

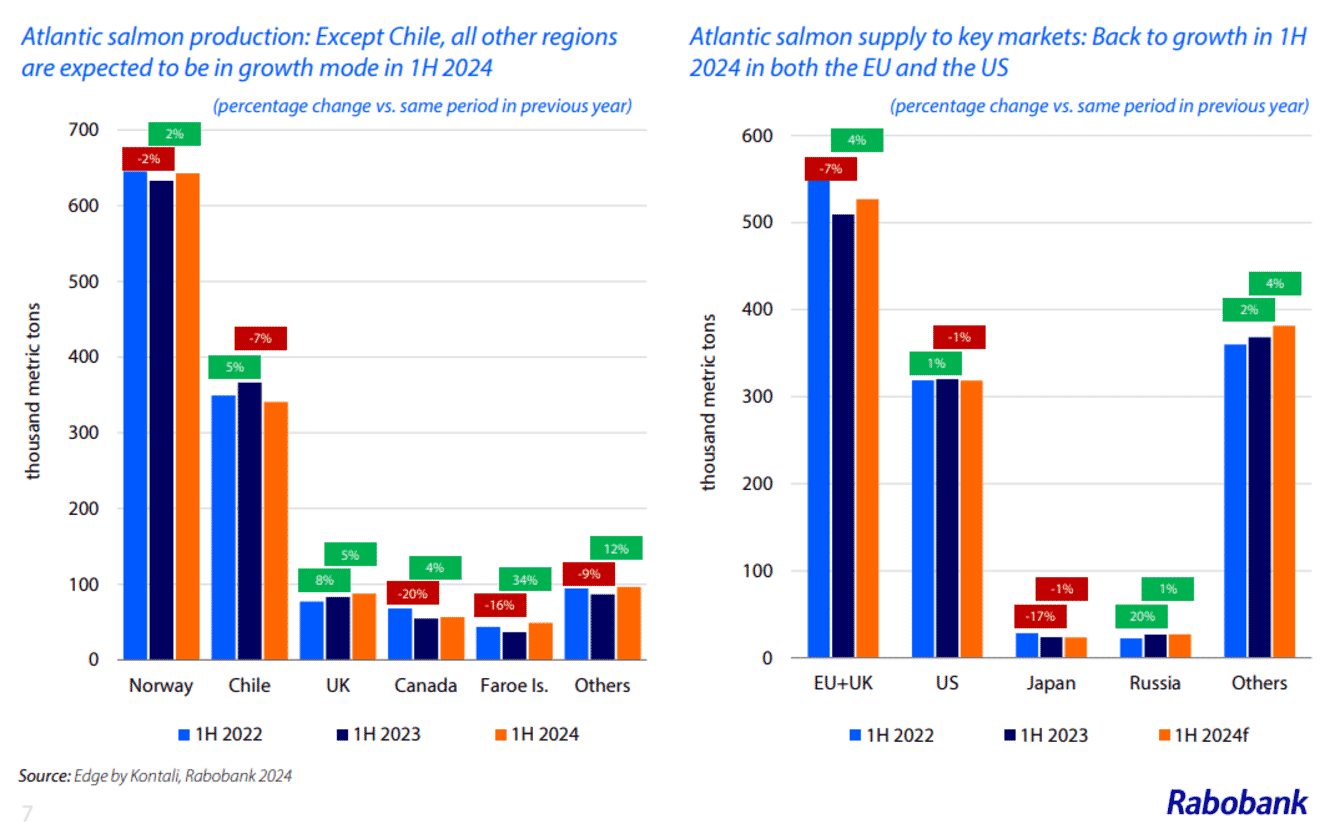

© Kontali and Rabobank

The ongoing success of salmon

On the other hand, while salmon producers are facing their own challenges – not least rising costs of production due to escalating biological issues in almost all salmon producing regions – Nikolik expects that most operators will continue to make a profits throughout 2024.

“As 2023 progressed it became increasingly clear that the expected switch towards growth in salmon was going to be very mild. The main driver of this change in expectations was Chile, which was both hit by El Niño-related issues with algal blooms and by legislation that forced any companies which had produced too much salmon to make up for this by reducing their production, and we expect a 9 percent correction in Q1, and negative growth for most of the year,” he observes.

“Norway was meant to be a lot more positive, but as 2023 developed, the biomass didn’t pick up, and harvest weights remained low in Q3 and Q4, reflecting that there are still biological issues, such as winter sores. So, while growth will become positive it won’t be as high as expected. So, overall H1 is going to have low single-digit growth globally,” he adds.

Coupled with strong demand, salmon prices are likely to remain high.

“There are signs that demand is improving and that the difficulties seen in H1 2023 – when there was a decline in disposable income, due to inflation and energy costs – have not continued,” Nikolik notes.

“So, overall demand is slightly better, supply is still tight and prices are almost the same high level as in H1 last year, although we may not have the same level of volatility that occurred last year. On average I see prices being slightly below, if at all, lower than last year

A win for all farmers

One positive outlook for the year ahead – which is likely to be equally uplifting for farmers of all fed aquatic species – is that the cost of feed is finally falling, after 3 years of inflation.

According to Nikolik, this is thanks to a better than expected anchoveta fishing season in South America in which 75 percent of the quota was landed. And this is likely to be compounded by the fact that the extreme El Niño that had been forecast didn’t materialise.

“If you look at the NOAA data, it’s really shifting from El Niño to La Niña. Six months ago we were expecting a super El Niño, which could have reduced fishmeal production for 2-3 years, as the water temperature was at record levels, but now it looks like the April fishing season might actually be good, so fishmeal prices are likely to correct to a more normal level. Meanwhile prices for soy have already corrected, so soon – probably in this half of the year – we’ll have a cost reduction in feed, which is good news,” he observes.