Led by Linda Chen, associate at Hatch Blue, and the Hatch Innovation Services team, the Emerging Protein-rich Ingredients for Aquaculture report aims to identify the most promising ingredients to complement existing sources of protein, expand the raw materials basket and bridge the protein gap in aquafeeds.

Reaching harvest volumes of 87.5 million tonnes in 2020, aquaculture production has exceeded that of capture fisheries, according to the latest FAO data. Driven by population growth, rising income, improved health awareness and urbanisation, global consumption of aquatic food is expected to increase by 15 percent to supply on average 21.4 kg per capita in 2030. To match this pace of consumption, aquaculture production is expected to reach 106 million tonnes in 2030. Underlying the growth of aquaculture is the accelerated demand for quality feed ingredients.

© Hatch Blue

As Chen explains: “Global aquafeed production reached 52.9 million tonnes in 2023 and is expected to increase exponentially to meet growing aquaculture production demand. Emerging ingredients play an important role to complement existing commercialised ingredients, improve the efficiency of feed formulation, and boost overall volumes.

“We hope this report can direct more capital and resources to accelerate the production and inclusion of these protein-rich ingredients along the value chain. We also hope it will spark conversations among regulatory and industry leaders to help establish more efficient new ingredient adoption processes.

“For startups looking to enter into the aquafeed market, we hope this report provides some insights into the ingredient trialing and inclusion processes, and help startups to better organise their resources.”

Incremental improvements with significant impacts

Hatch Blue is dedicated to helping impactful businesses scale in the aquaculture space. As feed contributes 30-80 percent of operational costs for most aquaculture producers, small economic improvements can have long lasting impacts.

“We want to provide patient capital and support ingredient startups through our accelerator and funds to break into the aquafeed market. We also want to provide the latest information to investors and industry players to help them identify suitable market opportunities,” Chen explains.

“We are grateful to our sponsor, the Gordon and Betty Moore Foundation, for their dedication to aquaculture and sustainability, and this opportunity for our year-long market research,” she adds.

Meanwhile the Moore Foundation explained that they supported the compilation of the report in order to improve both the sustainability and stability of the aquaculture sector.

“Aquaculture has been the fastest growing food production sector over the past twenty years, and it’s going to continue to grow,” said Bernd Cordes, program officer with the Gordon and Betty Moore Foundation’s Conservation and Markets Initiative. “That means the demand for aquafeed will also grow. For the aquaculture industry and its investors to inject greater cost stability and environmental sustainability into production systems, an in-depth understanding of the most cost-competitive, renewable and least environmentally damaging feed options is required. This study aims to be that guide.”

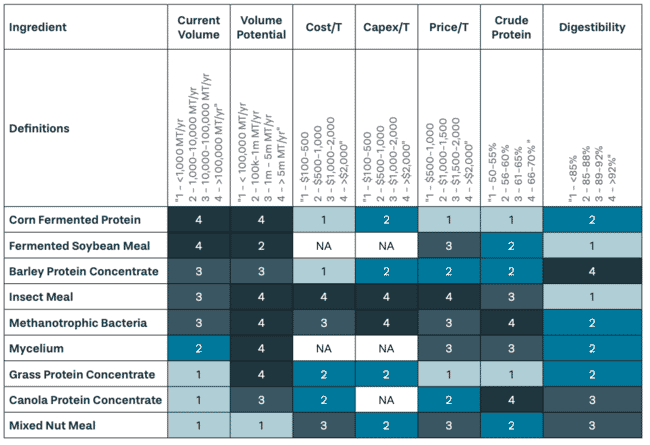

Following a preliminary assessment of hundreds of ingredients, the report narrowed down the list by focusing on the most competitive emerging ingredients that also contain at least 50 percent crude protein, as well as have the potential to both reach at least 100,000 tonnes of annual production and be included in aquafeeds at a minimum rate of 3 percent. The nine ingredients which met these criteria are:

- Corn fermented protein

- Fermented soybean meal

- Barley protein concentrate

- Insect meal

- Methanotrophic bacteria

- Mycelium

- Grass protein concentrate

- Canola protein concentrate

- Mixed nut meal

Where data is available, the report contains detailed assessments of nutritional profiles, estimated volumes, production costs and challenges, fair market pricing, scalability, regulation and life cycle assessments for each ingredient.

© Hatch Blue

Market trends

The research identified three trends in the market:

- The improvement of protein extraction and the reduction of anti-nutritional factors to convert existing low-quality raw materials into high-value ingredients.

- The repurposing of commercial processes developed in the early 1990s for new ingredient production.

- Genetic enhancement of existing agricultural crops for higher protein yields.

“We’ve found that, in the short term, by-products from existing agricultural and terrestrial production processes will contribute significant volumes of aquafeed ingredients. Upcycling low-value plant-based agricultural and ethanol by-products into protein-rich ingredients is associated with cheaper capex and production costs. The market is shifting toward the repurposing of brownfield infrastructure. The utilisation of waste materials can reduce the amount of landfill and contribute to a circular economy,” Chen explains.

The report also identified reasons for the slow adoption of new ingredients into the aquafeed market:

- Challenging production processes - setting up facilities to mass produce a single ingredient of consistent quality and quantity requires time, expertise and capital to overcome challenging engineering and biological hurdles. Especially for novel ingredients where production processes were not well understood or explored, the pioneer takes an unknown risk. Securing long-term offtake agreements can help alleviate some stress, but sometimes requires the completion of the trialling phase.

- Challenging financing processes - emerging ingredient production often requires significant upfront capital to finance essential infrastructure, although capital with aligned risk appetite is often limited. At early stages, capital sources are needed to bridge “the valley of death” between venture funding and risk-conscious institutional investment, as production ramps up.

- Long trials and sales cycles - compound feed producers take on a lot of risk when they include new ingredients. They must include demonstrable growth and health data to convince farmers and buyers. Emerging ingredients thus need to undergo rigorous in-house testing and long trial periods, and meet consistent production volumes and nutritional values before they are seriously considered for significant inclusion in aquafeed formulation. Long sales cycles are challenging for ingredient producers, especially when development costs are high, to sustain innovation and optimisation during the scale-up processes.

Goncalo Santos, head of projects at Hatch Innovation Services, Hatch Blue’s consulting unit, adds: “There is a clear need to diversify the raw materials used in aquaculture feeds, a move that not only fosters industry expansion but also confronts existing challenges associated with conventional ingredients. These challenges encompass limitations in volume, exemplified by the constrained availability of fishmeal, competition with human consumption, and diverse sustainability issues. The present study sheds light on this critical topic, examining alternative protein sources and elucidating the key success factors that companies must consider in their development trajectory.

“Ultimately, the objective is to produce ingredients at scale with minimal environmental impact, while simultaneously providing essential nutrients to farmed species and promoting the sustainable advancement of aquaculture.”