Founder and chairman, Martin Kelly explains to The Fish Site how the concept – which he believes can be profitable without carbon credits – works.

Can you give an overview of the business?

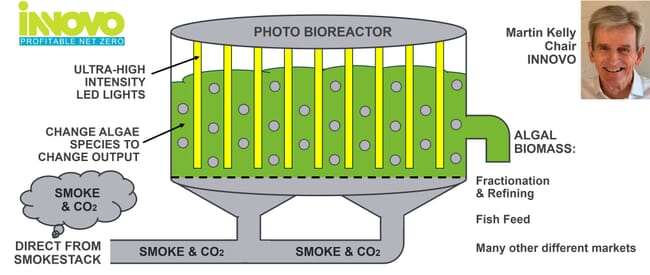

Innovo's biorefineries consist of modular photobioreactors in which algae consume CO2 emitted from fossil fuel-fired power generation and heavy industry. The resulting algal biomass is then processed upon harvesting into animal/fish feed, omega-3s and other nutraceuticals that enable CO2 emissions to be positioned as an asset instead of a liability.

What progress have you made in terms of the aquafeed sector?

Following successful small-scale production, offtake agreements for hundreds of millions of dollars of animal feed have been secured and large-scale production is about to start producing animal feed for poultry and cows, while bio-refineries have been proven to be capable of producing hundreds of thousands of tonnes of fish feed as well.

We can reverse engineer the fish feed specification to select the algae species to use. There are 100,000 different species of algae and their use in global fish feed markets is well proven. The difference with this production process is the scale of production. Current production methods yield 10 tonnes of fish feed per acre per year. One of our bio-refineries could produce 23,000 tonnes of fish feed per acre per year and we are about to start engaging aquafeed and aquaculture producers.

Why did you decide to use bioreactors?

Photobioreactors have been demonstrated to be the most space-efficient means of cultivating algae compared to how open ponds/raceways and bio-fences perform. Not only is algal biomass harvestable from open ponds limited because of requirements for plenty of land and direct sunlight, but also being exposed to the elements carries a high risk of contamination. Bio-fences, while enclosed, still require plenty of land and ample direct sunlight. Photobioreactors equipped with high-efficiency LEDs for interior lighting, in contrast, can operate 24/7 in any climate on a small land footprint, and are amenable to co-location on existing industrial sites.

Regarding Innovo’s choice of a tech provider amongst those that have reached technology readiness level [TRL] of at least 7 (commercially viable prototype ready) if not 8 (commercially deployed at small scale), we opted for one whose mission is aligned with our mission of halving global greenhouse gas emissions by 2030 and then achieving net zero carbon profitably. This provider's mission is to feed the world by using algae as a source of animal/fish feed so land and fisheries can be conserved for human food supply and preserved for biodiversity.

A bio-refinery is made up many photo bioreactors, each of which has many ultra-high intensity lights inside. Smoke from heavy industry is fed into the base of the photo bioreactor and the algae digests the CO2 to grow. The algal biomass is then harvested and goes through fractionation and refining to extract pure products for many different markets. © Innovo

What species of algae are you growing and is there scope to improve its productivity?

The species of algae will vary, based on the target product output and the composition of emissions being converted. Productivity of the algae will be continuously optimised using artificial intelligence and machine learning; for example, intensity of lighting over the course of a day or week can be adjusted in real time so that the growth and resting cycles of the algae lead to optimal overall production of algal biomass.

What has been the response to the concept from a) potential investors and b) the carbon credit market?

Prospective investors have been warm to the concept of biorefineries, especially in cases of offtake agreements that provide some assurance of future revenue and profit potential. We have not approached any carbon credit markets since carbon credits are not necessary for the biorefineries' profitability, given existing commercial viability of animal/fish feed and omega-3 and other nutraceuticals manufactured from algal biomass.

What have been the major milestones reached to date?

The technology was installed in five viable pilot bio-refineries at heavy industrial sites, such as cement plants, worldwide. The technology is now entering full scale industrial production, which is coming on stream over the next two months. Over two dozen large corporates in heavy-emitting industries, responsible for over 1.5 percent of the world's CO2 emissions, have expressed serious intent to order biorefineries upon financing, and offtake agreements for feed and nutraceuticals are already at a memorandum of understanding or letter of intent stage.

What challenges still need to be overcome?

While the technology is mature enough to attract serious interest from large private equity and debt investors, financing of bio-refineries is dependent on the heavy emitters’ shovel-readiness for projects and the firmness of offtake agreements. For example, a few memoranda of understanding for delivering the first series of bio-refineries may need to become binding. The greatest challenge now is globally scaling the technology fast enough to help halve global CO2 emissions by 2030.

How/where do you plan to scale up?

Scale-up of biorefineries requires buy-in from heavy CO2 emitters and establishment of offtake agreements with buyers of products from said bio-refineries. Once offtake agreements are established, the bio-refineries supplying the offtake become bankable through a combination of equity and debt finance, depending on investors’ preferences. Locations for large-scale deployment include any site owned by a heavy emitter willing to provide emissions, land, electricity, and water necessary to run a bio-refinery.

How does your concept compare with other forms of carbon capture?

Without linkage to markets for products manufactured from CO2, all other carbon capture technologies incur a cost to the emitter since the captured CO2 must be stored in perpetuity. Innovo's biorefineries generate operating profit per unit of CO2 converted into valuable products.

How do you see the company developing over the next decade?

Scale-up of Innovo's bio-refineries will occur in tandem with growth in demand for fish feed, animal feed, and nutraceuticals into the early 2030s. By then, most feed and omega-3 nutraceuticals will be derived from algae, and the total addressable market of feed and omega-3 globally will account for nearly two Gt of CO2 emissions avoided per year, equivalent to five percent of global CO2 emissions. Additionally, as bio-refinery modules fall in price through scale-up of production lines, it will become viable to produce algal bio-fertiliser that restores soil and enhances tree and crop growth, resulting in further net reductions of greenhouse gas emissions.

How have you financed the business so far and do you intend to raise further funding?

Innovo has been financed through contingent remuneration throughout its 13 years of existence, in which team members are remunerated on a day-rate basis with payout dependent on commercial revenues and investment proceeds generated through their activity with Innovo. Additional financing, likely from large family offices, private equity firms, and even larger institutional investors, will come in the form of both equity into the Innovo top co and equity or debt into the biorefineries so team members can start receiving cash against their day rates. We are now in an advanced stage of due diligence with an investment deal advisory firm specialising in large-scale green infrastructure projects whose clients are some of the world's largest asset managers, some with assets under management in the trillions of USD. Ultimately, such investors can experience a liquidity event in as little as 12 months from deployment of capital, thanks to willingness by investment houses to offer arms-length, single-strategy exchange traded funds that invest exclusively in Innovo and its affiliated ventures.