What makes Full Circle stand out from other insect producers, in an increasingly crowded field?

The main issue with insect products is the price-point. You can’t create impact if you’re solely replacing the use of industry by-products, which often happens with a high price-point, as customers are forced to sell to high-end pet producers (who would use waste from the slaughter industry anyway). This was the issue we targeted from day one. Impact is proportional to price.

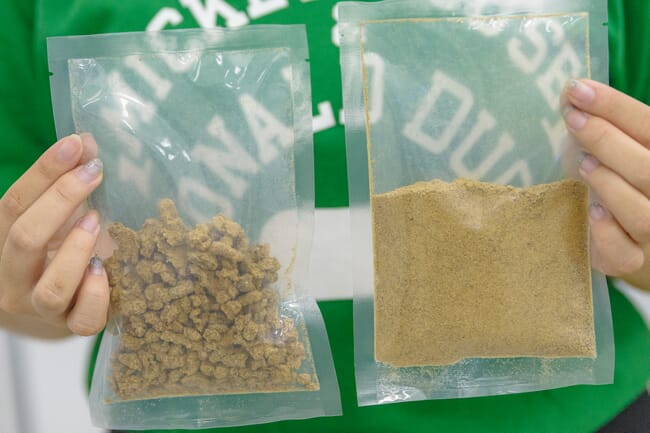

So we took a different approach. We use a combination of black soldier fly (BSF) rearing and fermentation to generate large quantities of useable biomass. As a result, for every 100kg of substrate we use, we generate about 24kg of product. This is almost ten times higher than most traditional BSF meal yields, though there is a growing degree of variability.

Full Circle says that its technology allows agricultural waste to be upcycled into an animal feed that is high in protein, cheap and low in carbon emissions

What have the major milestones been since you founded the company?

Things happened very slowly and then very quickly. I spent ages building the ecosystem approach in 2020 and it was only ready for testing in 2021. Proving the idea actually worked was massive. Big milestones then came thick and fast from our pilot:

- Proving our massive yield rate (2021).

- Getting preliminary results from shrimp feed trials that suggest insect proteins had a positive impact on survivability (2021).

- Proving a consistent yield rate across substrates (2021).

- Receiving demand requests of tens of thousands of tonnes per annum from some of the biggest companies in the world (2022).

- Getting into Katapult - the world's first impact accelerator with tiny acceptance rates - and onboarding them as our first VC (2022).

- Closing our pre-seed with a world-class team of angels and institutions (2022).

- Development of a footprint with the Norwegian salmon industry (2023, specifics TBA).

What are the major challenges you still need to overcome?

We’ve proved our core tech, but our next step is something pretty special. Because our efficiency is so high, we can generate a tremendous amount of protein within a very small area, even more so than traditional BSF processing. As a result, we’re currently building what we call the Black Box – a fully automated facility that can produce 6,000 tonnes of our protein per year using just 1,500 m2 of space.

This comes with many challenges, but the most significant for us is uniformity and consistency across borders. The Black Box is designed strictly to EU standards, but every new country still requires a thorough regulatory analysis and with some clients, their governments are slow to comment on BSF at all, let alone completely new technologies.

An initial venture trading black soldier flies from Thailand led to creating a unique feed ingredient out of microbes and insects and Full Circle Biotechnology was born

What role do the microbes play in the process and do they provide you with a wider range of products?

The microbes play several different roles, including increasing digestibility, generating biomass and enhancing protein quality, but they don’t provide us with a wider range of products. Everything goes into the end meal, which isn’t pure BSF meal but a combination of many different species.

How do you see the company evolving in the coming decade?

In a couple ways:

- Scaling – because our yield is so high, we want to use The Black Box to create local impact on a global level. The best way to do this is to go straight to the farmers and help them to cut-out fishmeal and soymeal while saving costs with our tech. Besides environmental impact, which we can create in most places, we also foresee working with governments and NGOs to tackle food security issues and we have a growing African footprint in preparation for this.

- Horizontal expansion – protein is hard to get right. Really hard. In trying to do it, we already found a conversion pathway for most waste streams into carbohydrate replacement. We can modify the Black Box to produce carbohydrates and expand into the carb market, helping us to localise an industry where the norm is inter-continental shipping. The footprint of carbs is much lower than proteins, but at scale we can still create significant impact and we intend to integrate them into the final aquafeed in the long-term, subject to testing.

Full Circle's feed has a carbon footprint that is almost 100 times lower than soymeal and almost 700 times lower than fishmeal

How do you see the wider insect-farming sector evolving in the coming decade – do you think there’s room for all the startups to survive?

I think even before the global economy started suffering, investors were quite sceptical of new BSF companies. The general thinking was: if you’re not doing anything significantly new, you will be outcompeted by bigger companies as they start to scale. There was a big race to scale during the first and second generations of insect companies (eg Protix and Nutrition Technologies respectively). New entrants will be outcompeted by the winners of that race, unless they are doing something dramatically different to typical BSF production.

Small efficiency improvements probably won’t beat economies of scale. I wouldn’t be surprised if in the latter half of the decade, we started seeing leaders getting some bargain M&A deals as those falling behind realise they have no competitive advantage. It’s important to distinguish between startups and SMEs, the former tending to have scalable potential and the latter representing most BSF companies that are slowly scaling and meeting local demand with no realistic large-scale ambitions.

The global economic shake-up might do the industry a favour, cutting out some of the new fledglings that have nothing innovative to offer but crowd the market. Consolidation feels inevitable, but entry costs are quite low and each country will likely have BSF SMEs that meet local demand. It’s unlikely that complete consolidation happens before the end of the decade, but we’ll see moves towards it. I think we will also see the franchise model get seriously tested and potentially abandoned if a champion doesn’t make it work.

Can you tell me a bit about your background?

I studied psychology with some business modules at Warwick. My first foray into business was in first year, when I learnt about Korsakoff syndrome (essentially severe alcohol-related dementia). I discussed this with friends after the lecture and, being students, the prospect terrified us.

A couple of us started to put vitamins and antioxidants into our drinks to counteract alcohol damage and, for transportation, I put them into a spray bottle. The next morning, I felt incredible, as did my friends. We decided we had to market this and raised a very small investment to do so, making a deal to sell it in Thailand.

Unfortunately, there was a major shipping issue and the bottles never made it. At this point, black soldier flies (BSFs) were all over the news due to EU acceptance in 2017 and, to recover the lost investment, myself and a Thai friend looked into trading them from Thailand. It turned out that there were no commercial facilities in Thailand and no Thai supply. That’s really what started our journey.

What inspired you to start farming insects?

Insects could make life a lot easier for the smallholder farmers who have a daily fight against poverty. Increased protein efficiency could give them larger margins and, when you’re a subsistence farmer, larger margins could be life or death.

Consequently I tried to work with smallholder farmers in Kenya with some friends. I was taken aback by the support for our mission. We made it to the last few companies in the regional final of the Hult Prize, but this was all focused on helping individuals to farm. It was only afterwards when I realised the scale of impact potential at the industrial level that I turned towards actual operation. Replacing one tonne of fishmeal can save almost 15 tonnes of carbon, depending on the fishmeal source. The opportunity to be responsible for reductions like that was a temptation too great to avoid.

Why did you choose Thailand as your base?

We were initially attracted by the market potential; it’s the breadbasket of Asia. But at the stage where we moved away from being a traditional BSF company and towards new technologies, we stayed here because of the competition. Thailand has possibly the lowest price of fishmeal in the world. For a company looking to distance themselves from the high cost of traditional insect products, this was actually a good thing. If we can make it work here, we can make it work anywhere, and we are already planning our international expansion.

How have you funded the company to date and are you looking for further investments?

We raised a healthy pre-seed with the help of many fantastic and helpful angels, as well as some terrific venture backers. We are always welcoming further investment.

What substrate do you use?

We can and do use a smorgasbord of different substrates and in most cases we leave this up to our clients. We can achieve a crazy protein range, from 10 to 70 percent, so it depends on the exact demand from customers, as well as their location. With one very well-known customer we’re using a mixture of abattoir by-product and by-product from the cassava industry.

Who are your customers?

We can’t discuss customers currently as we take confidentiality very seriously and our business relationships do include an assessment of competitive strategy. The Black Box could have significant impact on competition and supply chains, so we have to keep quiet until it fits our customer strategy. We have also secured a commercial collaboration partnership with a large salmon company in Norway.

Why is aquafeed such a good fit for the insect producing sector?

Aquafeed is a great fit for insect companies, providing the feed is for carnivorous fish. I think there’s added potential for the less carnivorous species, but not as great a fit.

The insect sector is, in general, a good fit for aquafeed because aquafeed benefits from more protein options and having one that can replace fishmeal is a good volatility-hedge as well as becoming increasingly important the more carbon taxation develops. The health benefits can also not be understated as a contributor to fish welfare. The sustainability angle does have a flaw due to the energy-intensive rendering processing typically used (something we don’t need to do), but it can make a lot of difference if it is replacing fishmeal. I’m excited to see how aquafarms view insect protein in 5-10 years and the degree of normalisation that occurs.