The report covers projections of global protein production for the year ahead, and the seafood element of it has been assembled by Gorjan Nikolik.

“While seafood production in China is expected to slow down, due to challenges caused by issues relating to health and climate,” Gorjan tells The Fish Site, “growth in SE Asia, Africa and - in particular - India, is expected to more than make up for it.”

Salmon volumes on the rise

The salmon sector is expected to experience 7 percent growth – continuing the upwards trends experienced in Chile and Norway during 2017, when the countries managed to bounce back from problems caused by algal blooms and lice levels the previous year. Indeed, global growth reached 5 percent, this year, a marked improvement from 2016, which saw productions levels fall by 7 percent.

While this trend is expected to mean that the prices are unlikely to return to the record levels of over NOK 70 per kilo, such as they achieved in the first half of 2017, the report expects they will remain above historical averages, most likely in the NOK 50-65 per kilo range, throughout the year.

“The peak of the price cycle may have passed,” reflects Gorjan, “thanks to increasing supplies in Norway and Chile. However, legislative restraints, particularly in Chile, are likely to slow down any increases in supply by the middle of 2018. We also expect growth to slow down again in 2019, thereby ensuring that prices remain strong, despite the usual volatility.”

Shrimp success predicted

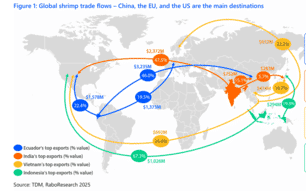

After a year of modest growth in 2017, the shrimp industry is also expected to increase production levels – with India, Ecuador and Indonesia helping to spearhead this growth. However, the report warns that this depends on early mortality syndrome (EMS) and Enterocytozoon hepatopenaei (EHP) – which hit the Chinese and Thai shrimp industries particularly hard in 2017 – being kept under control.

Demand is expected to keep pace with this growth, ensuring high prices, and the report also predicts prices to remain relatively stable, ensuring a solid year for the sector.

“A number of other high-end protein products have hit historical highs in recent years,” Gorjan explains, “and we think that this will keep up the demand for shrimp in 2018.”

Feed prices could drop

Landings from capture fisheries are also anticipated to increase, by 1-2 percent. And from an aquaculture perspective, perhaps the most exciting stock recovery is anticipated for Peruvian anchovies – which support the world's the largest fishery in terms of landing volumes, and provide the main source of the fishmeal and fish oil used in aquaculture feeds.

Following poor three poor years for the fishery, caused by El Niño, the report notes that 2017 landings experienced a marked improvement, and predicts the upward trend to continue in 2018.

Meanwhile prices are expected to remain keen for aquaculture feed manufacturers, in the range of $1,100 to $1,500 per tonne.

“Although the demand for fishmeal is high, with Chinese imports growing considerably last year, the projected increase in supply should ensure that prices don’t increase by much,” Gorjan reflects.