China's soymeal reduction campaign could be a boon for alt-protein producers

China is the world’s largest soybean importer, accounting for over 60 percent of global trade, with soybean imports mainly driven by crushing for feed production. Therefore, future imports will primarily be influenced by the outlook for feed demand and the soymeal inclusion rate in feed rations.

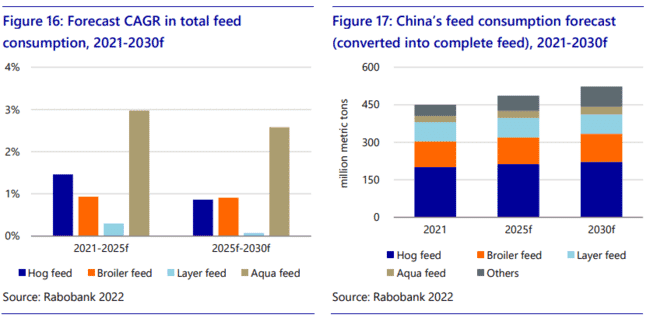

“We expect that Chinese feed consumption will maintain low-single-digit growth. However, the inclusion rate of soymeal in feed rations is projected to drop, as the Chinese government is launching a soymeal reduction campaign aimed at lowering the dependence on imported soybeans to ensure food security,” explained Lief Chiang, senior analyst – grains & oilseeds at Rabobank.

The Rabobank report argues that the reduction of soymeal inclusion in feed will create opportunities for startups to develop new technologies and novel ingredients - although this still might take some time.

“There are a number of startups focusing on novel feed protein sources, such as insect and microbial proteins. In the long run, these novel proteins will make positive contributions toward saving natural resources and reducing carbon emissions. However, as most of them are still in the development stage, there is high uncertainty about the timeline to achieve commercial viability in China,” the report suggests.

In the short-term, producers of key amino acids are set to benefit the most.

“In a low-soymeal inclusion scenario, extra use of amino acids will be necessary to meet the nutritional needs of animals,” explains Chenjun Pan, senior analyst – animal protein at Rabobank. Chinese amino acid players will benefit, but rising domestic demand might compromise producers’ ability to export and prompt foreign buyers to diversify their supply chains.

© Rabobank

Aquaculture set to grow

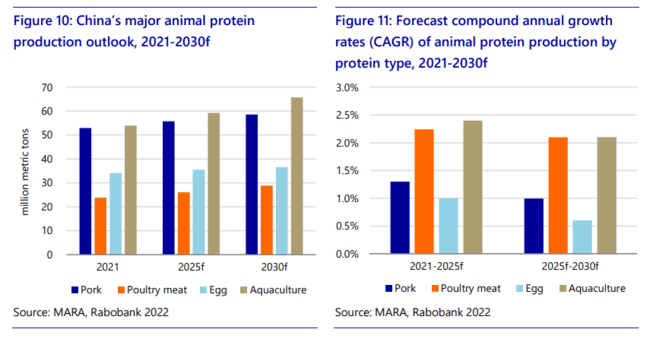

While the report suggests that the overall growth in China's animal protein production is likely to slow down, this will vary between sectors. And the authors argue that aquaculture - alongside poultry meat - is likely to fare better than pork and eggs, the markets for which are largely saturated already (see figs 10 & 11 above). Equally, the feed efficiency and low land use required by aquaculture is likely to make it more sustainable in the long term than pork.

Despite this, levels of soy in aquafeed are likely to decrease © Rabobank

Global repercussions

The authors argue that the projected slowdown and eventual reduction in China’s soybean imports will have profound impacts on the entire global supply chain and reshape global trade flows. It will challenge all participants along the chain, including growers, trade merchants, soybean crushers, livestock farmers, feed mills, and feed ingredient manufacturers.

“While China will remain the largest importer, additional growth will shift from China to other regions and mainly be driven by emerging economies in the Middle East, Southeast Asia, and South Asia. Merchants will need to realign their business for new destination markets and increase infrastructure investment in these regions,” notes Chiang.

Moreover, global soymeal trade volume is projected to increase at a fast pace. Driven by rising biofuel demand, the US and Brazil are expected to expand their crushing capacities and process more beans domestically, keeping more soy oil for local use and exporting increasing volumes of soymeal. This will benefit integrated merchants, especially those with crushing plants in the Americas.

While soymeal inclusion in feed is the largest determinant of China’s soybean imports, other variables may also impact soybean import projections.

“Rising domestic soybean production and direct soymeal imports would further lower the import forecast, while state stock buying would lift import quantities in some years,” explains Chiang.

“The government puts a high emphasis on food security, so it might encourage imports or conduct stock buying to replenish state reserves as a buffer against various risks like adverse weather, supply chain disruptions, geopolitical tensions, natural disasters, etc. Complex economic relationships might also lead to state purchases to balance trade accounts,” says Chiang.

“Though additional government procurement will temporarily increase import projections in some years, the impact would be short term.”