Chinese consumers are increasingly looking for high-value seafood species

The report documents ways in which consumers are changing both the way they shop and the types of products that they are looking for.

“Consumers are adopting a more rational and practical value proposition and focusing more on value for money and the fundamental value of products and services. At the same time, they are willing to pay for high-value products that offer fulfillment and allow them to experience new things, as long as they think the price is reasonable. Moreover, health issues, such as obesity are already challenging specific consumer groups, and triggering some to seek a balanced diet and focus on health and nutrition,” the authors note.

“How to eat well instead of how to eat more has now become the focus of many Chinese consumers,” it adds.

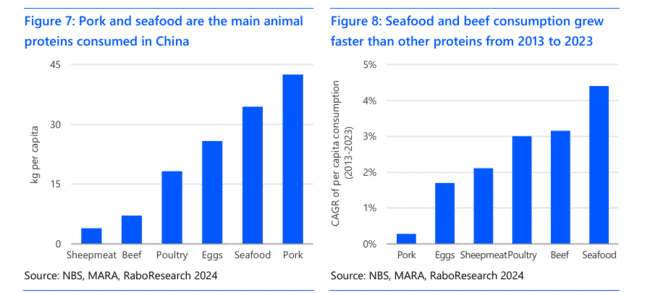

As a result of this trend, the report predicts a continued decrease in the demand for pork – which accounted for 85 percent of animal protein consumption in the 1990s, but had fallen to 53 percent by 2023. On the other hand it forecasts an increased demand for seafood, as well as for beef and chicken – continuing a trend that has seen growth in seafood consumption (at 4.4 percent CAGR from 2013-2023) occur more rapidly than for any other animal protein.

However, within seafood the authors expect that high-value products will account for most of this growth, while more traditional low value seafood products, such as carp, will remain flat or even show a slight decline.

“Consumers also have a positive perception of seafood. Demand for premium products increased the consumption of higher value seafood, including shrimp, wild-caught fish and deep sea fish, over traditionally consumed carps. China’s seafood imports increased rapidly between 2010 and 2013 at a CAGR of 11 percent, driven by rising local demand for good-quality seafood. Shrimp, the largest item in terms of value, has seen a sixfold increase in the last 13 years. We expect seafood imports to maintain an upward trend in the coming years, despite the slowing economy,” the report predicts.

© NBS, Mara, RaboResearch

The meteoric rise of live-streaming

One of the most intriguing parts of the report relates to the steep rise in sales based on live-streaming – through channels such as WeChat, Pinduoduo and ByteDance.

Consumers can learn how to cook certain products on these channels and then order the ingredients straight from the streaming platform, typically at a lower price than in the supermarkets.

According to the report details that sales through live-streaming increased by a CAGR of 85 percent between 2019 and 2023, while its share of online sales rose from 4.3 percent to 32 percent in the same period.

“Some food companies were reluctant to sell through this channel two years ago, but now almost all companies have developed live-streaming distribution,” the report reflects.