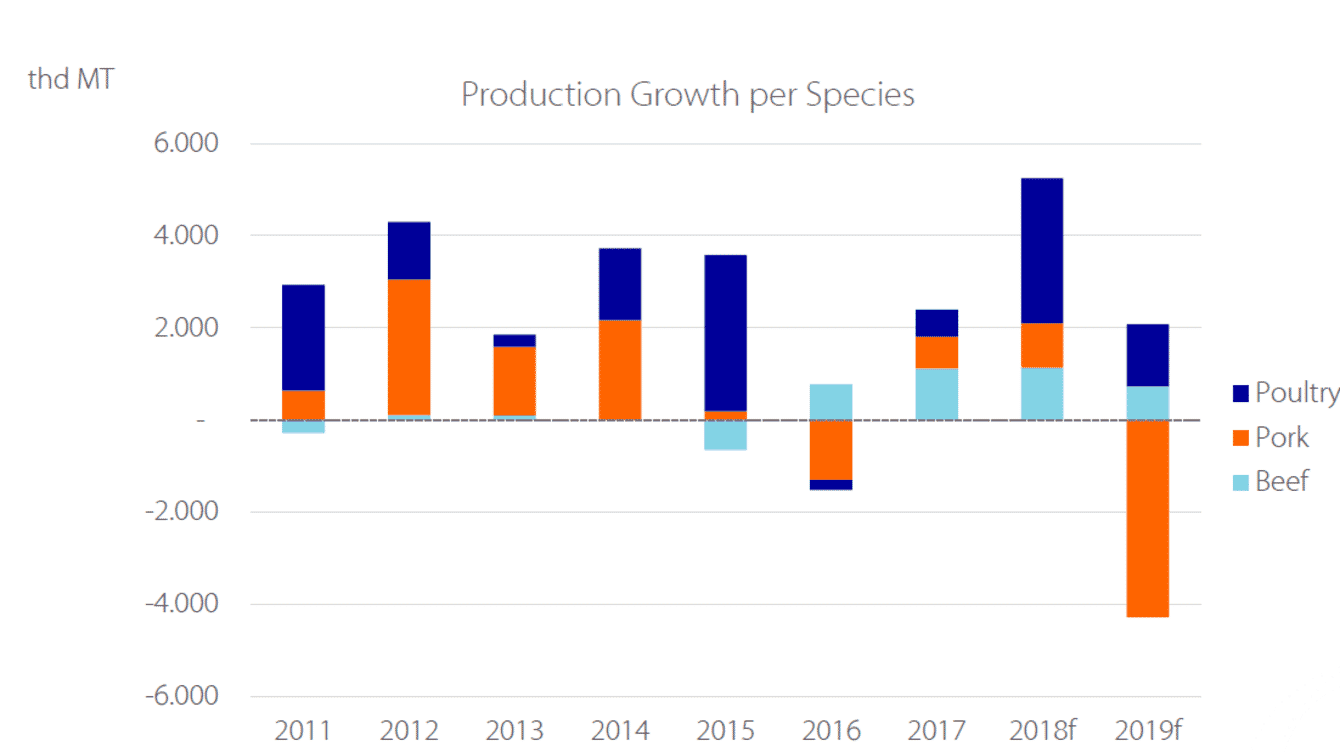

The current ASF outbreak, which was first noted in China, but has since been detected across Asia and Europe, is likely to create opportunities for the seafood sector – not least in China, where pork production could decline by as much as 10 per cent (the equivalent of 5 million tonnes of protein) in the year ahead.

So points out Gorjan Nikolik, Rabobank’s senior seafood analyst. Following up on a very popular presentation he gave at the North Atlantic Seafood Forum in Bergen, he spoke to The Fish Site about the knock-on effects that swine fever is likely to have on global protein markets.

“China produces half the world’s pork – pork production is so important there that it can have an impact on the country’s rate of inflation. And ASF, which has now spread to key pork-producing regions in Asia and Europe, is going to lead to a major correction in global animal protein production after two years of growth,” he explains.

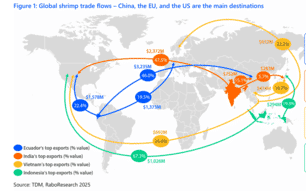

This presents a golden opportunity for seafood exports from other countries, as China will look for alternative animal proteins. However, he adds, that other animal protein producers will be eyeing up the opportunity in China too, not least in North America, where a surplus of the massive pork and chicken sectors by 3 and 4 percent respectively, will outstrip domestic demand.

However, whether the US will be able to offload this surplus to China remains to be seen, due to the ongoing trade dispute between the two nations – currently China has a 50 percent import tariff on pork imports, and a complete ban on chicken, from the US.

© Rabobank

Meanwhile the EU is predicted to have a surplus of pork but, equally, whether they will be able to export this to China hangs in the balance – with a number of ASF outbreaks on the Continent threatening the export trade.

“Of particular concern are a cluster of cases of ASF in wild boar in and around Luxembourg. If these are not contained it could spread into Europe’s key pig-producing regions – France, Germany, Benelux and Denmark – which would impact EU pork production and limit the possibility of exporting pork to China,” Nikolik explains.

“As a result of these factors the seafood sector must follow the dynamic very closely. Whatever happens, China is likely to become an even greater importer of seafood, especially if the EU is unable to export its surplus pork there,” he reflects.

And this opportunity is likely to be ramped up by other factors.

“Chinese consumers are becoming wary of poultry, following numerous deaths from avian flu over the last few years and ASF – which spread through the wet market in China – is driving more consumers towards major retailers and even online shopping, both of which present further opportunities for seafood importers,” he notes.

What’s more, he adds that the decrease in pork production could free up more of the fishmeal market for aquaculture.

“A reduction in demand for fishmeal from China’s pork sector could help to reduce global fishmeal prices, thus further benefitting aquaculture producers,” he concludes.