This, and other key trends in the sector, are among the features illustrated on a new salmon farming data dashboard launched by Planet Tracker, a think tank highlighting financial risk exposure related to ecological limits in a variety of industries.

The dashboard, which was launched yesterday, has been designed to to help investors in the salmon aquaculture sector pinpoint financial exposure to environmental risks. It aims to provide dynamic and regularly updated information to the financial community on the nature and impact of market practices and investment in critical ecological industries.

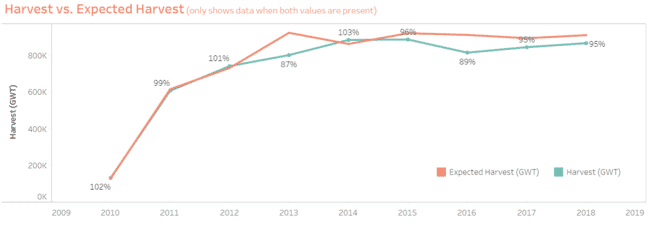

For example, analysis presented on the dashboard shows that, since 2015, salmon harvests have – on average – been 6-8 percent lower than forecast by the world’s top 10 salmon producing companies.

© Planet Tracker

“Companies and investors failing to implement effective sustainability strategies, which will require short term capital commitments, face medium term production and profit margin pressure,” warns Planet Tracker.

Speaking at the launch of the dashboard yesterday, Matthew McLuckie, director of research at the think tank, said: "We are dealing with sectors with investors that are unaware of the constraints that they face, and the losses that companies are both reporting and exposed to as a result of these environmental constraints – and the salmon dashboard clearly proves that.

"Our first port of call is therefore to work with investors to understand these issues and understand how the environmental data can interact with financial metrics, and undertake their own analysis around company valuations to understand their own future growth potential and investment strategies in these sectors. Ultimately, we hope to identify companies that are operating in the most sustainable manner, and those that are the least sustainable."

"Our overarching theory of change, which is backed up by the data, is that companies operating from a more environmental perspective generally face lower volatility in terms of performance and see less losses – certainly in the agriculture and aquaculture sectors.

"Our work is fundamentally more powerful if we have these institutional investors, who in themselves are representing pension funds, speaking to the executives of these companies about our research, than if it was limited to the civil society or NGO community. As such, we are really looking at capital markets as agents of change in these sectors."

One of the discrepancies that the salmon data dashboard highlights is the number of salmon mortalities that are either unattributed or unexplained. This, he noted, should be a cause for concern among investors.

As McLuckie explained: "As you can see from the salmon dashboards, the largest reason for salmon losses is 'no reason given'. Our hope is that investors will look at the dashboards and push companies to improve their reporting around losses. Rather than changing production methods, we hope to see increased transparency in reporting losses and mitigation measures to reduce those losses."

It is perhaps this, rather than putting pressure on salmon farmers to change their production methods, that he sees as being the most important role for the dashboard, from a salmon industry perspective.

"We believe that current salmon prices put the technologies necessary for the transition to sustainable farming at scale out of reach, putting further pressure on coastal farming in its current form. As a result, we expect to see a lot of innovation in the coming years – Mowi, for example, has already started investing in new net technology," McLuckie reflected.

The tracker is also, he explained, also intended as a resource for investors, the media and researchers.

Response from the industry

The Fish Site asked McLuckie what the response to the initiative from the salmon industry had been to date.

"The salmon farming companies haven’t seen the dashboards yet, but the response we’ve had to the reports has been positive. This is mainly down to our approach – we aren’t an activist think tank, but we merely take data that is already publicly available, and we are quick to praise companies who are behaving well. In fact, we have a paper coming out that focuses on the positive efforts of the salmon industry," he explained.

"Salmon companies are engaged with our research, and interested in how they can engage their investors on these issues," added McLuckie.

COVID-19 and the global economy

Touching on the impact of the coronavirus in the Q&A which followed yesterday’s presentation, McLuckie reflected how the pandemic had caused salmon prices to drop, had reduced the movements of staff and caused serious dislocations in the supply chain.

And looking at the wider economy, not just the salmon sector, he predicted that: “Companies without balance sheet resilience are going to go bust… which could lead to a greater concentration of producers.”

He also noted that while “producers always say that demand will be met, COVID shows that this is not always the case”.

As a result of the disruptions in global food supplies, he added, that "food will become a vital political bargaining tool in the near future... as we see greater fragmentation in supply chains."

Further information

- The information presented on the salmon aquaculture dashboard is taken from a 2019 report, Salmon feels the heat, by Planet Tracker.

- As well as the aquaculture industry, Planet Tracker has also launched dashboards on wild-catch seafood and publicly-listed food and agriculture investment funds.

- The think tank also intends to launch a dashboard for shrimp aquaculture soon, based on Shell Shock, their recent report on the sector.

- Planet Tracker is due to publish a paper next month that focuses on the positive efforts of the salmon industry.