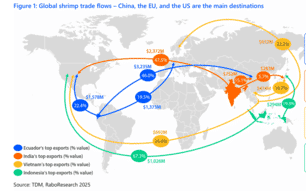

Speaking at Benchmark Capital Markets Day, Rabobank’s senior seafood analyst Gorjan Nikolik noted that the second half of 2017 might have marked a turning point for the global shrimp industry – with increased production in India and Ecuador set to make up the shortfall from China and Thailand.

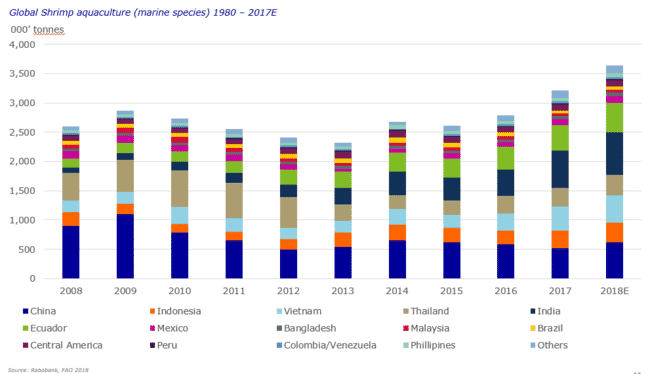

© Rabobank and FAO

Indeed, he observed, in 2010-2017 shrimp production from the former two countries has risen by approximately 650,000 tonnes – virtually mirroring the 700,000 tonne drop in the latter pair – and he predicts that global shrimp production will increase from 3.2 million to 3.6 million tonnes in the year ahead. And, despite this increase, he forecasts shrimp prices – which are currently at over $4 per lb for L. vannamei and almost $9 per lb for P. monodon - will remain remarkably stable.

“The shrimp industry in China and Thailand has struggled to recover from the impact of early mortality syndrome (EMS) but both countries have now stabilised and are retuning for mild growth,” he reflected, “while increased production in countries such as Ecuador, India and Indonesia in the year ahead should fuel a significant increase in global shrimp production.”

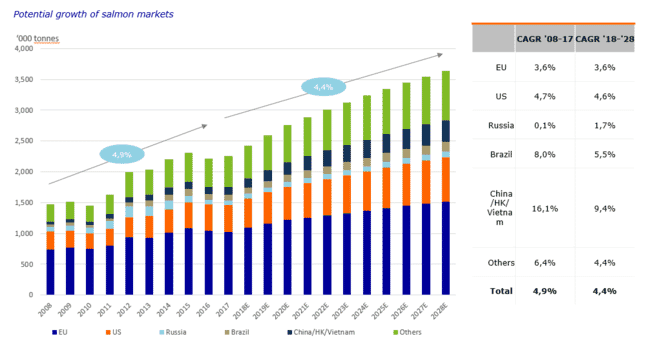

Salmon: stable prices, despite strong growth

Meanwhile he predicts that salmon markets will continue to grow at almost the same rate in the coming decade as they have in the decade that has just passed – forecasting a 4.4 percent increase in demand over the next 10 years, just a fraction lower than the 4.9 percent growth seen from 2008-2018. And he predicts a 5-7 percent growth in global salmon production this year, followed by 5 percent growth in both 2019 and 2020. He also adds that prices – currently at around NOK 70/kg for HOG salmon in Norway – should come down a little during the year, but remain high for the foreseeable future.”

© Rabobank & Kontali

“The salmon sector has ground for optimism in the decade ahead,” he observed, “with growth in demand likely to keep pace with growth in production, ensuring solid prices and allowing producers to make the necessary investments to counter the health challenges that the industry faces in many countries today.”