Accessible industry data allows accurate predictions for salmon supply - in 2016 the global supply was 2.1 million tonnes and the expected growth this year is 5% (100,000 tonnes). However, data allowing the prediction of the regional demand for Atlantic salmon is comparatively sparse. Indeed, we often refer to this as “the dark side of the moon” as we have a lot of data for supply and little data on the demand side.

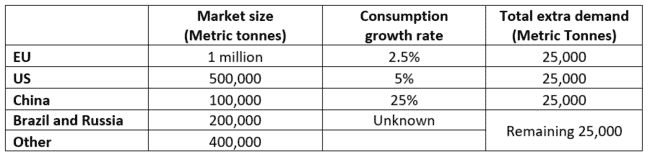

The EU, US and China currently make up more than 70 percent of the global market for Atlantic salmon and are going to take up 75% of the 100MT of extra supply each year, given these projected demand growth rates. The rest of the world (~30% of the global market), including Brazil and Russia, are therefore set to compete for the remaining 25K MT, emphasising the tightness of the supply. As a result we are very unlikely to see prices decline within the next 1-5 years.

China: market size 100k, consumption growth 25% (25k MT) per annum

Over the past 3 years China's primary salmon supplier has shifted from Norway to Chile. The market size during this time has been stable at around 100K MT per annum. However, there are several long-term drivers that favour growth in the import of high value species such as salmon.

Coinciding with income growth and economic development, there has been a significant improvement in the logistical infrastructure in China allowing for import of fresh seafood, especially in the urban centres.

There has been a change in consumer behaviour in China beginning with an increased distrust of local seafood. Traditionally, the Chinese market has focussed almost solely on whole fish but more often young and middle class consumers are opting for imports and online produce. Online sales are growing and it is the sale of more convenient fillet fish that is fulfilling this demand. This presents a great opportunity for the Norwegian industry, who have so far been very successful in marketing salmon online and look to return to the Chinese market without the constraints they have felt for the past few years.

Additionally, it is becoming more common to reject traditional cuisines such as shark fin soup due, to a government frugality drive and awareness campaigns by conservationists, according to Wild Aid. According to the charity's report, 85% of Chinese consumers surveyed online said they gave up shark fin soup within the past 3 years.

The potential market for salmon in China is huge and I am bullish in my forecast of a 25% pa growth in demand.

EU: market size 1 million MT, consumption growth 2.5% (25k MT) per annum

The EU is the most mature and stable market for Atlantic salmon. It is currently dominated by Norwegian supply and has seen wholesale prices double since the end of 2015. Despite the high price level I anticipate a demand side growth of 2.5% per equivalent to 25k MT. If the price were to drop, a 3% growth in demand could be expected per annum.

US: market size 500k MT, consumption growth 5% (25k MT) per annum

The US is almost as mature as the EU but it is more competitive. Whilst Chilean fresh fillet dominates, there are inputs from Norway, Canada and the UK (as well as from wild catch), which have kept prices competitive. In comparison to the EU, prices were low for most of 2015 and only began increasing after the harmful algal bloom in Chile in the first half of 2016. As part of the price increase was absorbed by retailers, the current retail prices are only recently reaching the previous peak recorded in 2014. This relatively low price point will allow consumption growth to be greater in the US market.

For a mature market, it is uncommon for an undeveloped niche to be discovered. However, Marine Harvest has publicly identified that the US market for fresh prepacked fillet, which had been a cause of good growth in the EU, is a potentially rich seam. It is the cause of much of the growth in the US market and is accelerating at a rate much higher than the EU.

The more competitive market has kept prices lower than the EU. Then couple a strongly recovering Chilean industry as a key supplier with the accelerating appetite for an undeveloped markets my forecast is for an exceptional 5% pa growth in consumption.

Brazil and Russia: combined market size 200k, growth very hard to estimate

Brazil and Russia represent a substantial market at ~200k MT. However, predictions on their future demand are very difficult to give, due to the current political climates of these two countries.

Russia: Current sanctions, trade embargos and currency fluctuations make the market very difficult to predict. Despite EU and Norwegian fish being banned from entering Russia, it is still making its way there through Belarus. Russia has planned to establish a new aquaculture hub in Tatarstan which aims to compensate for the lack of salmon imports from Norway. While the species to be farmed has yet to be named, Vasily Sokolov deputy head of the Russian Federal Agency for Fisheries, said there is a “market niche” in Russia for salmon and trout.

Brazil: The current political instability in Brazil with allegations of corruption as well as fluctuating currency values make the market very difficult to predict again.

Other: market size 400k MT

It would be fruitless of me to make predictions about the rest of the world as a collective. It includes countries with a strong growth in demand such as Australia and Turkey, countries with flat demand like Norway and declining demand such as Japan. However, they are important to consider as this large and diverse market will be competing with Russia and Brazil for the remaining unaccounted 25K MT of additional supply per year.