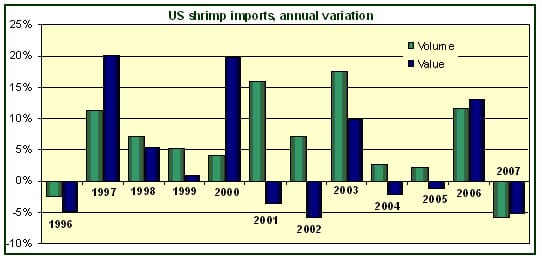

Fall in volume of imports breaks a ten year trend

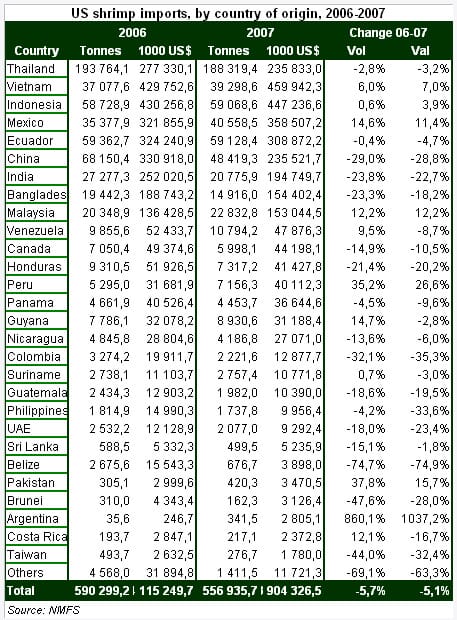

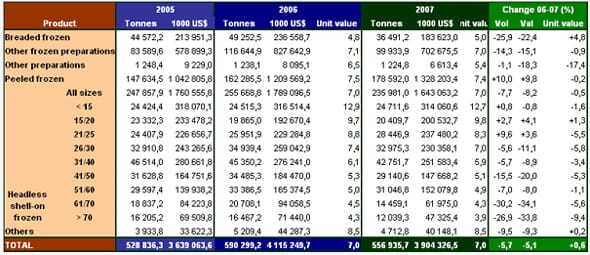

During 2007, imports amounted to 556 935.7 tonnes worth U$S 3 904.3 million, which represents a 5.7% and 5.1% reduction in terms of volume and value respectively, compared to the previous year.

|

This trend was shown in almost all products, excepting peeled frozen shrimp and some sizes of frozen shell-on shrimp, which were the only products that grew in volume and value. As for the unit value of imports, it remained almost unchanged (+0.6%).

Several factors have affected the shrimp market throughout 2007, the increase in oil prices that recently passed the US$ 100/barrel level, the slowdown of the economy, the reduction in consumer confidence, and the health issues with Chinese seafood, among others.

As can be seen in the graph above, since 1997, US shrimp imports have grown continuously, at higher or lower rates but always positively in terms of volume. As for the imported value, the behaviour has been more erratic, in line with changes in international prices and the structure of imports. Although frozen shell-on shrimp (considering all its sizes), is still the most imported product, products with more value addition, such as peeled frozen shrimp, breaded frozen shrimp, and other frozen preparations (a category that includes cooked shrimp and meals prepared with shrimp, among other products), have remarkably increased their share of imports.

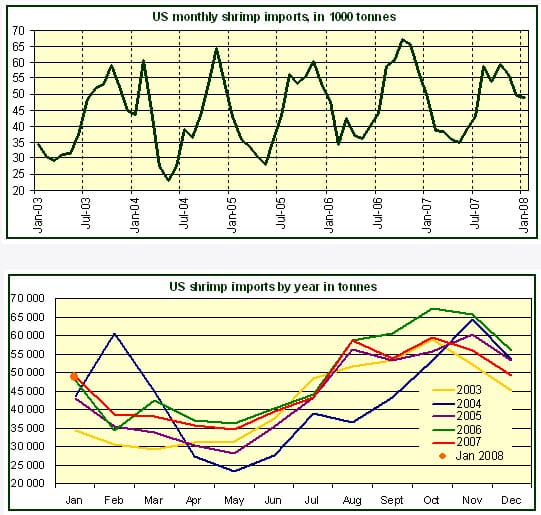

The seasonal behaviour of imports can be seen in the following charts. Usually monthly imports decline until May, when they start to go up. But in 2007, the recovery of imports between August and November, months when the higher monthly imports can be observed, was remarkably lower than in previous years. One important event, preceding this change was the blocking of imports from China in June, due to health issues.

Main suppliers: Thailand keeps gaining market share despite lower sales.

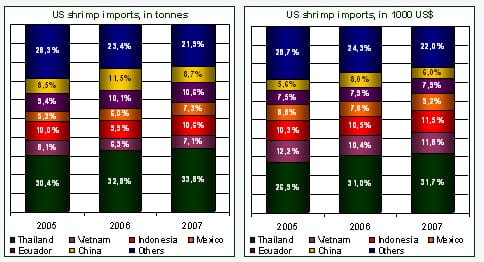

Thailand was the top shrimp supplier to the US market during 2007. Thai sales to the US accounted for 34% of total traded volumes, and 32% of the value of imports. The second supplier in terms of volume during 2007 was Ecuador, which accounted for almost 11% of imports. It is interesting to note that in 2006, the second supplier to the US was China, and in 2007, this country was placed fourth, after Indonesia. The Chinese share of imports during 2007 fell almost 25% in terms of volume, from 11.5% in 2006 to 8.7% in 2007. The variation was similar in terms of value.

In terms of value, Thailand is also the leading supplier, with a value of trade of US$ 1 235.8 million, this nation accounts for 32% of the value of imports. But in terms of value, other key suppliers change their ranking. The second most important seller to the US market during 2007 was Vietnam, with US$ 459.9 million and a 12% share, Indonesia with US$ 447.2 million (11.5%) and Mexico with US$ 358.5 million (9%). Ecuador, the second supplier in terms of volume, is placed fifth in terms of value with US$ 308.9 million and an 8% share.

All the five top suppliers managed to increase their market share both in terms of volume and value. Among these countries, the most remarkable results were shown by Mexico, which increased its sales to the US by 15% in terms of volume and 11% in value, and managed to gain market share, +22% in terms of volume and +17% in terms of value, when compared to the shares in 2006 (4% and 8% respectively) to the shares in 2007 (7% and 9%). It is also interesting to note that last year, the concentration of suppliers grew. The main six providers (Thailand, Vietnam, Indonesia, Mexico, Ecuador and China) accounted for 78% of the imported volume and value, while in 2006 their total share was 76.6% and 75.7% in terms of volume and value respectively. Despite the fact that Thailand showed a reduction of trade both in terms of volume and value (-2.8% and -3.2%), Thai products gained share in the total foreign supply of shrimp, given that total imports experienced a bigger drop.

It is worth noting the remarkable growth of Argentinean exports. After completely disappearing from import statistics in 2005, in 2006 it resumed its sales of shrimp to the US, and during 2007, it showed a remarkable growth, +860% in terms of volume and +1 037% in terms of value, to reach 341.5 tonnes worth US$ 1 037.2 million. However, its share in total trade is still low. 84% of total exports from Argentina to the US is frozen shell-on shrimp, and the remaining 16% is peeled frozen products.

As for the type of products sold, 34% of the imported volume from Thailand is other frozen preparations, and 31.4% is peeled frozen shrimp. These two items account for more than 65% of total imported volumes and over 68% of total value (35.5% and 33.3% each). 51.7% of sales from Vietnam consist of peeled frozen shrimp, and a similar trend can be observed in sales from Indonesia (peeled frozen shrimp accounts for 50.6% of Indonesian sales to the US market). In the case of China, 53.5% of the volume sold to the US during 2007 is breaded frozen shrimp, and 24.3% is other frozen preparations. Another interesting point is that while Asian countries focus their sales to the US market on products with more value addition, the main Latin American suppliers, are mainly providers of frozen shell-on shrimp. This line of production accounts for 90% of the quantity of exports from Mexico to the US, and 77.4% of sales from Ecuador. For the latter, if each size category of shrimp is considered a different product, the most important line of production is peeled frozen shrimp (21.2% and 25.5% of total volume and value respectively).

The WTO ruled again against the US bonding policy and the SSA advocates for stricter controls for imported products

In February, the World Trade Organization (WTO) ruled again in favor of a complaint presented by an exporter regarding the US 100% continuous bond policy. In this case, the successful nation was India. After having ruled in favor of Thailand, the WTO stated that the US practice regarding Indian exports is illegal, and the conclusion of the WTO confirmed the preliminary results of the dispute regarding the practice of “zeroing”. As reported in previous reports, Ecuador had already its tariffs eliminated by the Department of Commerce (DOC). More recently, after the third administrative review, the DOC dropped duties for 29 Vietnamese shrimp firms, for frozen warm water shrimp. These companies had their duties slashed to zero, while the average duty for Vietnamese shrimp is 25.76%. Meanwhile, the Thai company Thai Union Frozen Foods stated that they would appeal the preliminary results of this review, given that the DOC decided to maintain their duty (15.3%), and expect to get results before the final report is issued in September.

After this series of findings against the US foreign trade policies on shrimp, Brazilian shrimp producers are analyzing the next moves to take. Brazilian exports of shrimp were seriously affected by the tariff increase on sales to the US, and since 2003 have gone down to just 327 kilos in 2007. After the closure of this market, an important part of the production went to the domestic market, and as a result, domestic shrimp consumption in Brazil in the past four years grew about 500%, accounting for 60% to 70% of Brazilian produced shrimp. Despite the eventual elimination of the tariff barrier, the main problem nowadays is the appreciation of the Real, which has resulted in the domestic market becoming an attractive destination for domestic producers.

The trend US dollar trend is also affecting Thai and Indian producers. The strengthening of the Thai Baht, relatively stronger than increases in other regional competitors’ currencies, has adversely affected Thai competitiveness. Also, shrimp producers are trying to reduce their level of output in order to improve the price level in the domestic market. One of the recent measures taken by the government that could favor shrimp production is a plan to cut the import tariff on soybean meal from 4% to zero. This measure would help reduce the cost of feed production for aquaculture. As for India, the Seafood Exporters Association of India (SEAI), met with the Prime Minister to ask the government to provide policy support to the industry. According to the representatives of the SEAI, Indian exports of shrimp have been seriously hit by the appreciation of the Rupee, and exports have dropped by 20% in Rupee value. The shrimp industry has also been affected, according to the members of the delegation that met with the Prime Minster, by the increase in oil prices, the antidumping measures applied by the US, and the increasing competition by other countries in the region that harvest vannamei shrimp instead of black tiger, with lower production costs.

Going back on the WTO decision on bonding policy, the Southern Shrimp Alliance (SSA), stated that the US should appeal on this ruling. According to this association, the bonding assures the US the capacity of collecting the duties for imports, and the level of tax evasion in shrimp imports is much lower than in other imports, which they attribute to the bonding policy. Also, according to the representatives of the SSA, this weakens the trade relief on dumped imported shrimp products.

On another matter, the SSA director, John Williams stated to a Congressional Committee, that the Food and Drug Administration (FDA) is failing regarding quality controls on imported shrimp. According to his statement, the FDA’s controls are limited, reaching only 1% of imports, and test for only a limited number of contaminants. Another failure, according to the executive, is that the FDA does not require exporting countries to have health legislation for exports that meet with US food safety standards. He said that this has an impact on US consumers, the shrimp market and the shrimp industry. First of all, the presence of contaminated shrimp combined with consumers’ inability to distinguish between safe and unsafe shrimp depresses overall consumption and demand for shrimp in general. Secondly, when distributors are aware of contamination problems for aquaculture shrimp products, they can offer lower prices which pushes down prices in general. And finally, this creates difficult conditions for US producers of wild caught shrimp which is not affected by diseases but finds a market with lower prices to compete with. He also said that given the stricter controls of food safety in other major markets, the US has become the destination for seafood products that have been rejected or have lower quality. According to the SSA director, some of the measures that should be taken in the short term by the FDA, to enhance the quality of seafood imports are: the requirement of equivalence agreements on food safety laws and procedures in the country of origin; higher inspection and test rates, even reaching 100% in case of new exporters or exporters that fail the controls on previous shipments; increase the FDA’s test capabilities with more laboratories and qualified staff; and authorize the banning of imports from a country or supplier that does not meet the standards and does not show signs of improvement; among other measure proposed. According to some analysts, this is a strategy of the SSA to increase the level of non-tariff barriers on shrimp imports.

Imports fell for almost every product

During 2007, excepting peeled frozen shrimp, and some sizes of frozen shell-on, imports of the remaining products fell both in volume and value. Peeled frozen shrimp had the best performance during 2007. Imports of this item grew 10% in terms of volume and value. The sizes of frozen shell-on that did not decrease in volume terms were 15 pieces and less, 15/20 and 21/25 pieces/lb. The most significant drop was shown by the 61/70 pieces/lb size. Imports of this size fell 30% in quantity and 34% in value. Regarding the unit value, the best performance was shown by breaded frozen shrimp (+5%) and the biggest reduction in unit value was suffered by imports of “other preparations” (-17%).

Headless shell-on: Headless shell-on: Last year this was again the most important import category, with 235 981 tonnes worth US$ 1 643 million and it accounted for 42% of total imports, both in terms of volume and value. Trade in this item fell both by volume and value compared to 2006, -7.7% and -8.2% respectively. The unit value was lower for all sizes excepting 15/20 (+1.3%), and the overall drop in unit value was marginal at 0.5%. The main imported size was, in terms of volume, 31/40, with 42 752 tonnes, accounting for 8% of total imports and 18% of total imports of headless shell-on shrimp. Total share of headless shell-on shrimp in total imports in terms of volume fell from 43.3% in 2006 to 42.4% in 2007, and in terms of value, from 43.5% to 42.1%. The leading supplier of this product was Thailand, with a 24% share of volumes and a 20% value share (56 023 tonnes worth US$ 325 million). The second major supplier in the headless shell-on category during 2007 was Ecuador, with 45 787 tonnes and US$ 224.7 million (19.4% and 13.7% of total imports respectively), followed by Mexico (15.5% and 19.5%). These two Latin American countries managed to enhance their market share in this line of production compared to 2006, when they accounted for 17.8% and 13.1% of total volumes each. The top three suppliers jointly accounted for 58.6% of total volumes bought from foreign providers. The most imported size from Thailand during the past year was 26/30 (22% of total imported volumes of headless shell-on from that country), from Ecuador, 51/60 (22%), and from Mexico 21/25 (37.5%). The main suppliers of the several sizes can be seen in the chart above.

Peeled frozen: As noted above, this category is the only one which during 2007 showed a positive variation. Imports reached 178 592 tonnes worth US$ 1 328.2 million. In comparison to the 162 285.5 tonnes worth US$ 1 209.6 of 2006, this represents a 10% and 9.8% increase respectively. Also this category increased its share both in total imported volume and value, from 27.5% and 29.4% respectively in 2006, to 32.1% and 34% in 2007. The top player in this category is Thailand, with 59 114.5 tonnes worth US$ 412 million, it has a share of 33% and 31% of the quantity and value of imports of peeled frozen shrimp. The second place as the top supplier is taken by Indonesia (29 889.1 tonnes; US$ 225.3 million), followed by Vietnam (20 332.3 tonnes; US$ 236.7 million). These three nations together account for 61.2% and 65.8% of the volume and value of imports of peeled frozen shrimp. Unit value of purchases of this product remained almost unchanged, but the result for each supplier is uneven. For Thai products, it grew 1.4%; for Indonesian products the variation was +3.4%, in the case of Vietnamese shrimp, the unit value showed a slight growth (+0.9%). Meanwhile, in the case of the fourth and fifth suppliers, Ecuador and Malaysia, it fell in comparison to 2006, -1.2% and -8.9% respectively.

Breaded frozen: Purchases of this product fell 26% in terms of volume and 22.4% in terms of value. China dominates the supply of breaded frozen shrimp, with a 71% share of total volumes and 62% share of total value (in 2006 the Chinese share was 81% and 73% respectively). Sales of Chinese production fell 35% both in quantity and value compared to 2006, most likely as a result of the health problems detected by the FDA in June. Indeed the drop of Chinese sales is the main factor behind the reduction in trade for this line of production. Thailand, has managed to increase its share in this market segment: while in 2006 it accounted for 13% of total volumes and 17% of total values, in 2007, the respective shares increased to 20% and 26%. It can be said that Thai exporters managed to seize the opportunity generated by the measures taken by the FDA. Unit value of imports of breaded frozen shrimp grew 4.8% in 2007, but for the two most important suppliers it remained almost stable (+0.1% for China and -1.1% for Thailand). Most remarkable is the growth of sales from Indonesia, +74.5% and +64% in volume and value, getting the third place among the top suppliers, but still well behind them.

Other frozen preparations: This is the third most imported item, with 99 934 tonnes worth US$ 702.7 million. The average unit value for this group of products did not show a significant variation during 2007 (-0.9%). This category includes, among other products, cooked shrimp and meals prepared with shrimp. The main supplier is Thailand, accounting for 64% of volumes and 62.5% of values (64 070 tonnes worth US$ 439 million), and sales from this country fell 9% and 12% in terms of volume and value respectively during 2007 compared to 2006. The second supplier is China. Trade of this item with China also had a significant reduction during 2007, -33% and -36% in volume and value respectively. With 11 755 tonnes worth US$ 63.2 million, Chinese products accounted for 12% and 9% of total trade respectively, while in 2006 their share was 15% and 12%.

Domestic supply and market prices trends

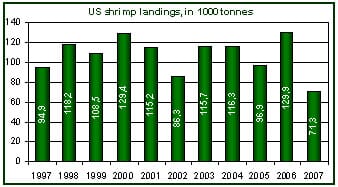

In 2007, total domestic landings of whole shrimp were 45% lower than in 2006 (71 252 tonnes vs. 129 899 tonnes). It is worth noting that 2006 was considered an exceptional year, because there was an increase in available stocks, due to the lower production during 2005 as a consequence of the Katrina hurricane. However, in 2007, landings fell below the level registered in 2005 (96 937 tonnes). Low landings are still evident, and this has allowed domestic Gulf shrimp to show a stable level of prices, given that supplies are adequate for the level of demand.

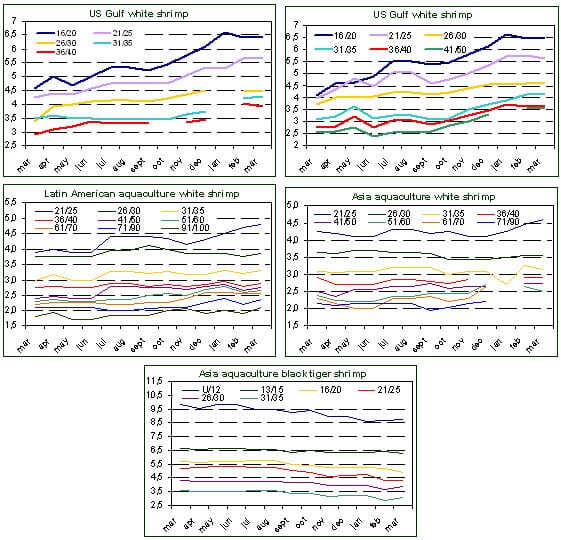

Price trends for many imported products remained mostly stable, except for some sizes for which prices increased significantly, such as 21/25 aquaculture shrimp both from Asia and Latin America. On the other hand, domestic shrimp, during the past year presented an upward trend, which at the beginning of 2007 started to slow down, and has currently stabilized, as it can be seen in the charts below. In the following graphs, ex-warehouse prices in New York, all in US$/lb, are indicated.

Per capita shrimp consumption fell in 2007

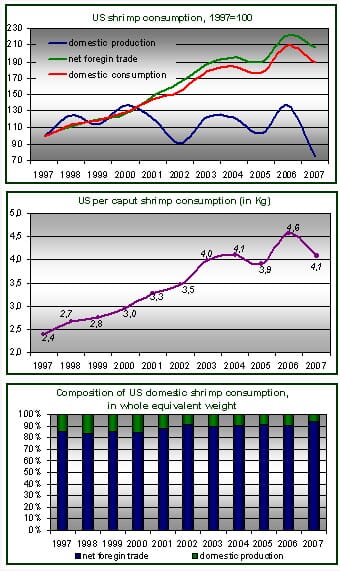

After registering a peak in 2006, US per capita shrimp consumption fell 10.7% in 2007, from 4.6 kg in 2006 to 4.1 kg whole shrimp equivalent and similar to the 2004 level.

This fall in domestic consumption is both a result of lower imports and a 45% drop in landings. In 2001, the net foreign supply (NFS) of shrimp to the US (estimated as NFS=imports-exports-reexports) broke a trend in which its growth accompanied the behaviour of domestic consumption, and started to increase in volume above the domestic consumption rate. As can be seen in the chart below, the main reason for that change is that most of the increases in domestic consumption of shrimp were accounted for by an increase in imports, and not by higher domestic production. In fact, since 2001, whole equivalent imports have accounted for over 90% of domestic consumption of shrimp in the US, and in 2007, this share was 94%, the highest in the last ten years.

OUTLOOK

The US economy appears to be heading for what many analysts see as the beginning of a recession. What at first seemed to be just problems in the financial system has also become a problem in the non financial sector of the economy. The tightening of credit, the higher level of prices, and the negative perspectives for the level of employment, have contributed to a drop in consumer confidence to the lowest level in five years, according to a Consumer Confidence Index. Consumers are reported to be already changing some consumption habits, moving to cheaper varieties of groceries, or to lower-cost substitutes. The slowdown of the economy will surely affect the restaurant industry, one of the main channels of consumption. Already in 2007, this industry grew just 1%, according to some researchers. Also, consumer spending, which accounts for two thirds of economic activity in the US, is reportedly slowing down; even in December, a month in which it usually increases, it remained almost unchanged compared to the previous month. All this sets a particularly uncertain scene for shrimp consumption and demand, taking in consideration that it is often seen as a luxury item.

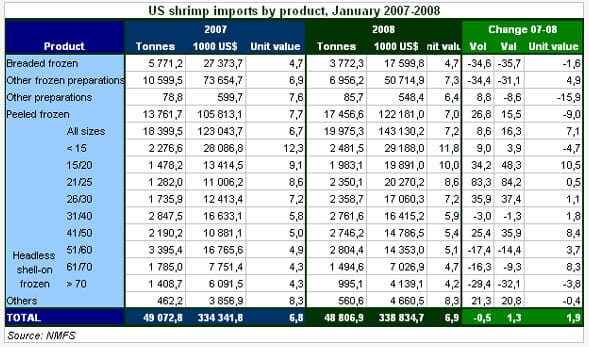

Regarding initial 2008 indications, January landings of shrimp grew 42.6% compared to January 2007, but the level of activity is considered slow. January imports remained almost unchanged compared to January 2007, -0.5% in volume and +1.3% in value. This slight overall variation, is mainly due to a growth in imports of peeled and headless shell-on shrimp almost compensating a fall in volumes for the remaining products. Based on forecasts for the economy, an increase in demand for shrimp may not be expected at this point.

Regarding supply, two facts should be highlighted for the current year. First of all, the various rulings of the WTO against the zeroing and bonding policies along with likely duty cuts following the administrative reviews of the DOC should grant better access to the main suppliers . On the other hand, the SSA has started a campaign (which many see as a strong political lobby strategy) to enhance controls on imported shrimp in order to restrict access to the US market to low quality products. Many see this campaign as a way to establish non-duty barriers to imports, not to protect US consumers but the domestic production.

May 2008