Record Prices Expected for All Four Feed Grains

This report summarizes the initial U.S. Department of Agriculture (USDA) supply and demand projections and U.S. price prospects for the 2008/09 marketing year. Because planting of spring crops is still under way in the Northern Hemisphere and remains several months away in the Southern Hemisphere, these projections are highly tentative. Projections are based on USDA surveys, economic analysis, judgment, and the assumption of normal weather.

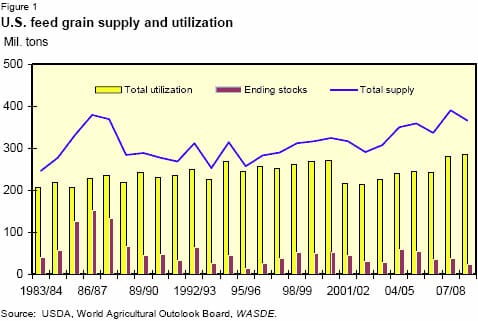

Forecasted feed grain area planted in 2008, based on the March 31 Prospective Plantings, is down 7 percent from 2007. Acres to be planted in corn are expected to be down 8 percent. Total feed grain supplies for 2008/09 are forecast down 6 percent. However, strong domestic use of feed grains, boosted by a 33-percent rise in corn used to make ethanol, is expected to keep ending stocks very low, down 40 percent from 2007/08. With plentiful supplies of distillers’ grains from ethanol production in 2008/09, feed and residual use is expected to total 143 million tons for the four feed grains, down from 164 million in 2007/08. Record prices are expected for all four feed grains.

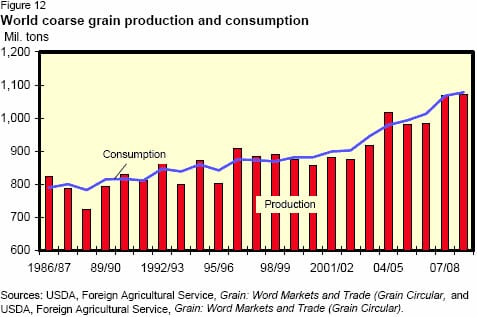

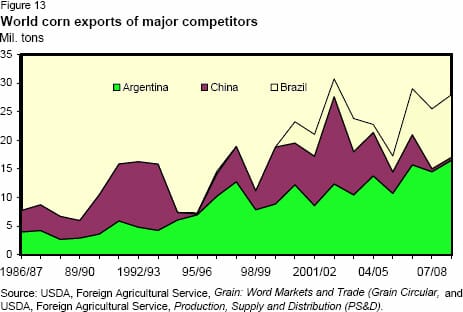

Increased competitors’ corn exports, coupled with a decline in world corn imports and high U.S. corn prices, are expected to cut U.S. corn exports 10 million tons in 2008/09 to 53 million. World coarse grains production in 2008/09 is projected up slightly to a record 1.07 billion tons. The increase is driven by high prices that make coarse grains, especially corn, more profitable for many producers than most other crops. World coarse grain consumption in 2008/09 is projected at a record 1.08 billion tons, a year-to-year increase of 1 percent. Foreign consumption is expected to increase 1 percent to 793 million tons, limited by a drop in EU-27 use caused by increased wheat feeding. Healthy economic growth in many countries is supporting meat demand and small increases in coarse grains feed use.

Domestic Outlook

Feed Grain Production Down 26 Million Tons

U.S. feed grain production for 2008/09 is projected at 325 million tons, down from 351 million in 2007/08. This year-over-year decrease stems from smaller projected planted and harvested area for corn, sorghum, and oats. Barley production is expected to increased from that in 2007 because of a slight increase in planted and harvested, acres, plus expected higher trend yields.

For the four feed grains combined, planted and harvested area is down in 2008/09, and yield is projected higher. Planted area is based on producer intentions reported in the March 31 Prospective Plantings. Harvested areas and yields are projected for corn, sorghum, barley, and oats (for more complete descriptions see the following sections for each commodity). Beginning feed grain stocks are 38 million tons in 2008/09, up from 36 million in 2007/08. Total 2008/09 feed grain supply is projected at 366 million tons, down from 390 million.

Feed grain use is expected to decline in 2008/09, despite higher ethanol production. Feed and residual use is expected to decline 21 million tons in 2008/09 to 143 million. High feed prices are expected to encourage more feeders to include distillers’ grains in their feeding rations. Exports are expected to slip from 72 million tons in 2007/08 to 58 million in 2008/09. Food, seed, and industrial (FSI) use is projected at 142 million tons in 2008/09, up from 116 million in 2007/08, nearly all on increased corn and sorghum use for ethanol. Ending feed grain stocks are projected to decrease 15 million tons from the 38 million in 2007/08. Recordhigh prices are expected for all of the feed grains.

Changes to 2007/08 Balance Sheets

Changes were made to corn, sorghum, barley, and oats for the 2007/08 marketing year. Corn used to make ethanol was lowered 100 million bushels, to 3 billion, reflecting lower utilization of existing ethanol plants as reflected in the monthly Energy Information Administration data and various reports of delays in getting new plants in production. Sorghum imports were increased 1,000 bushels, reflecting trade data for the first half of the September-August marketing year. Forecast barley imports were increased 3 million bushels to 23 million, reflecting stronger-than-expected imports in the third quarter of the June-May marketing year. Oats imports were lowered 5 million bushels, reflecting a lower-than-expected pace in the first three quarters of the June-May marketing year. Oats exports were increased 500,000 bushels, reflecting stronger exports to date.

Feed and Residual Down From 2007/08

The 2008/09 feed and residual use for the four feed grains plus feed wheat on a standardized September-August marketing year is projected at 146 million metric tons, down 22 million from the previous year. Feed and residual use per grainconsuming animal unit (GCAU) is projected at 1.56 tons in 2008/09, down from 1.77 tons in 2007/08, in part reflecting higher expected feeding of distillers’ grains. Total GCAUs are projected to be down 1 percent over the period to 93.5 million. GCAUs are expected to be down because of reduced numbers of cattle on feed and reduced sow farrowings.

The following is a breakdown of animal production estimates for calendar year 2009:

- Beef production is expected to be 26.5 billion pounds, down from 26.8 billion a year earlier,

- Pork production is forecast at 22.9 billion pounds, down 2 percent from 2008,

- Poultry production is projected at 43.3 billion pounds, up from 43.1 billion in 2008,

- Egg production is expected to be 7.6 billion dozen, nearly unchanged from a year earlier, and

- Milk production is expected to be 190 billion pounds, up slightly from 2008.

International Outlook

Record World Coarse Grains Production Projected

Global coarse grains production in 2008/09 is projected to reach a record 1.07 billion tons, up slightly from 2007/08 as foreign increases more than offset the expected U.S. drop. World corn production is forecast down 2 million tons to 778 million as the foreign increase does not quite offset the U.S. drop. World barley production is projected up 8 million tons to 142 million, with the largest increase expected in Ukraine. Global sorghum production is expected to decline 2 million tons to 63 million, with foreign production little changed in aggregate. World oats production is expected to continue to decline slightly, but rye production is projected up 13 percent.

China is expected to be the world’s second largest producer of coarse grain, reaching 158.5 million tons. China’s corn area is expected to decline slightly as the price of soybeans is high enough to cause some switching in the Northeast. However, trend yields imply an improvement over the previous year when extensive dryness and heat constrained yields. Corn production is projected to reach a record 150.0 million tons in 2008/09, up 5.0 million from 2007/08. Sorghum production is forecast down, but barley up, due to an expected increase in area planted.

EU-27 coarse grain production is projected up 9 percent to 149.4 million tons in 2008/09. Area harvested for grain is forecast up 0.5 million hectares to 32.7 million. High prices for wheat and oilseeds are limiting planted area for feed grains, but with normal weather, abandonment is expected to be less, especially in countries that suffered severe drought a year ago. Also, average yields are expected to rebound. EU-27 barley production is forecast up 4 percent to 60 million tons, while corn production is projected up 16 percent to 56.1 million tons, reflecting the greater damage done to the corn crop a year ago. EU-27 oats production is forecast up slightly, to 9.0 million tons, but rye is expected to increase more than 20 percent to 9.3 million.

Coarse grains production in the former Soviet Union (FSU-12) is projected up 14 percent to 61.5 million tons. A return to average yields is expected to boost barley production in Ukraine 4.0 million tons to 10.0 million. Winter barley was hurt in Ukraine and Russia in 2007/08, but spring barley in the eastern production areas of Russia and Kazakhstan had better-than-average yields. A return to average yields boosts barley yield and production in Russia, up 1.4 million tons to 17 million, but implies a decline in expected barley production in Kazakhstan. Improved corn yields are expected for Ukraine, Russia, and Moldova, boosting FSU-12 corn production 2.9 million tons to 16.7 million. Russia’s oats area and yield are projected lower, reducing FSU-12 oats production, but FSU-12 rye production is projected up slightly.

South America’s coarse grains production is projected to increase 5 percent in 2008/09 to reach a record 101.6 million tons. This is very much a projection as the 2007/08 crop is still being harvested in Brazil and Argentina, and the 2008/09 crop will not be planted for months. Corn prices are expected to be strong enough to encourage an expansion in corn area in Brazil, more than offsetting a return to average yields and boosting production 1.0 million tons to a record 57 million. In Argentina, area is projected flat, as it is unclear what incentives and disincentives producers will face given the ongoing difficulties with government interference in export marketing. A return to trend yields boosts corn production 2 million tons to 23.5 million.

Coarse grains production in Sub-Saharan Africa is projected up slightly to 94.2 million tons. South Africa’s corn production is expected to remain unchanged in 2008/09 at 11.5 million tons, with an increase in area offsetting a return to trend yields. Nigeria’s production is expected to increase with improved rains.

South Asia’s coarse grains production is projected down 6 percent to 41.6 million tons, mostly because of India, where a return to average yields for corn, sorghum, and millet imply a reduction.

Coarse grains production in the Middle East is projected down 9 percent to 16.6 million tons. Winter rains have been poor across most of the region, reducing barley production prospects. Parts of North Africa also suffered from poor winter rains, and coarse grains production is projected to remain below 10 million tons for the third time in 4 years.

Australia’s barley production is projected to rebound from drought, more than offsetting a decline from record sorghum yields in 2007/08. Australia’s coarse grains production is projected up 23 percent to 12.2 million tons.

In Canada, wheat and oilseeds prices are expected to reduce area for barley, oats, and corn, cutting 2008/09 coarse grains production 10 percent to 25.0 million tons.

Mexico’s corn area and yield are projected up slightly, boosting coarse grains production 1 percent to 30.0 million tons.

World Coarse Grains Use To Grow Slowly in 2008/09

Tight stocks and record high prices are expected to slow the growth in coarse grains use in 2008/09. World use is projected to increase 1.1 percent to 1.08 billion tons, much slower than the 5.3-percent growth forecast for 2007/08. Foreign use is expected to increase more slowly than in the United States, mostly because the EU- 27 is expected to feed more wheat and less feed grains in 2008/09. Foreign feed and residual use is expected to increase 1.0 percent, while total foreign coarse grains use increases only 0.8 percent. Coarse grains use other than feed and residual in non-U.S. countries is mostly human food use, and that is expected to grow very slowly, at less than population growth in 2008/09.

EU-27 coarse grains use is projected down 4.2 million tons in 2008/09 to 148.2 million. With a sharp rebound in wheat production, much of which is of poor quality for milling, the EU-27 is expected to increase wheat feeding and reduce imports of corn and sorghum. Canada, with reduced coarse grain production prospects, a strong currency, and a struggling meat production sector, is also expected to reduce feed grains use slightly.

China and Brazil, with record corn crops, are expected to increase coarse grains feed consumption significantly in 2008/09, and most other regions are expected to have modest growth. These increases offset the EU-27 decline in use, leaving foreign use up modestly. However, they do not offset the dramatic drop in projected U.S. feed use, leaving global coarse grains feed use down 2.4 percent in 2008/09.

Further Reading

| - | You can view the full report, including tables, by clicking here. |

May 2008