Outlook positive for pangasius

In addition, negative press coverage in Italy and Germany scared consumers away from buying of pangasius. All over the world, local fishermen are complaining that the fish from Viet Nam is creating unwanted competition by undercutting prices substantially. At the moment, it is probably the only fillet on offer in Europe below EUR 10.00/kg. On the other hand, because of low prices paid to pangasius farmers in 2008, the area devoted to breeding has been reduced.

In the Mekong Delta, the country’s major pangasius breeding region, the area devoted to breeding the fish was reduced by 600 hectares, to 5 240 hectares at the end of last year. In provinces that are leading producers of pangasius, such as An Giang and Dong Thap, 30 per cent of the ponds are lying unused after farmers suffered losses because of oversupply last year.

As a result of the reduction in supply, prices were moving upwards in the opening months of the year, both in Viet Nam and in the European market. This price hike came to a stop in May 2009, as competing species report declining price levels. Prices of pangasius at the origin started to decline sharply.

After 10 years of developing pangasius breeding and processing, the fish is exported to 107 countries and territories. Viet Nam plans to produce between 1.3 million tonnes and 1.5 million tonnes, and export USD 1.5 billion worth of the pangasius products in 2009. Last year, the Mekong Delta produced 1.2 million tonnes and exported 633 000 tonnes of pangasius products worth USD 1.4 billion.

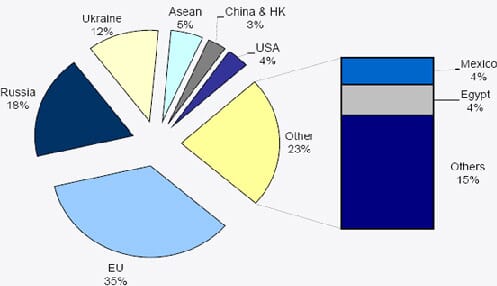

In the first four months of this year, Viet Nam earned USD 375 million from exporting 163 000 tonnes of pangasius, a slight decrease compared with the same period last year. In terns of quantity, exports were more or less stable. The main export recipient was the EU with 65 000 tonnes, or 40 per cent of the total. Within the EU, Spain is reportedly the major importer of pangasius from Viet Nam, reporting a 10 per cent increase in its imports. In the present economic situation, the Spanish consumer prefers the relatively cheap pangasius fillet over more expensive traditional products.

The distribution of benefits in the value chain for pangasius, from the small scale fish farmer in Viet Nam, to processing in relatively large processing companies, to finally being offered for sale in the European market is quite informative. Of the final sales price of EUR 7.00/kg, 10 per cent goes to fish farmer, 10 per cent to the fish collector, 20 per cent to the processor, 20 per cent to the trader and the remaining 40 per cent to the retailer.

Exports resume in major markets

Egypt has affirmed its official resumption of granting permits for Vietnamese pangasius to be exported to Egypt. Recently, incorrect information about Vietnamese pangasius was published in Egyptian newspapers, implying that pangasius was unsafe for consumers. The misinformation resulted in negative perceptions by Egyptian consumers, forcing the Egyptian Embassy in Hanoi to halt temporarily the granting of permits to local traders to export pangasius to Egypt. Egypt is the sixth most important market for pangasius and imported some 26 600 tonnes in 2008.

Viet Nam plans to export 100 000 tonnes of pangasius to Russia this year, after that country lifted an import ban in April 2009. Last year 118 000 tonnes of the fish were shipped to Russia before pangasius imports were prohibited in late December 2008. It was put in place after some shipments of Vietnamese seafood were found to be contaminated with banned chemicals. Russian authorities also claimed that Vietnamese exporters progressively lowered prices to compete with one another, hurting Russian importers. Russian authorities have now fixed a minimum price of RUB 78/kg (USD 2.30/kg) a kilogram. Violators will be fined USD 50 000 and banned from importing Vietnamese seafood.

At the end of June 2009, Viet Nam had exported over 10 000 tonnes of tra and basa fish at USD 3.10/kg to Russia since 25 April 2009 when Russia officially reopened its market to Vietnamese fish. In July alone, another 15 000 tonnes of fish are expected to be shipped to Russia, as a number of Russian importers asked for more of tra and basa from Viet Nam in the form of both packaged fillet and whole fish. Apart from Russia, demand from many other foreign importers such as East European, African and American countries are strong.

In May 2009 the New Zealand Federation of Commercial Fishermen attacked a government move to allow the import of catfish from Viet Nam, saying it could dominate the fish and chips trade and ruin the local industry. The market for New Zealand's hoki dropped by 90 per cent when Vietnamese catfish imports were allowed into Australia,

US imports of catfish (including pangasius) declined somewhat in the first three months of the year: some 11 500 tonnes were imported during the first quarter of 2009, 7 per cent less than in the same period of 2008. While Viet Nam, the top exporter of catfish to the US market reported a modest increase in exports, Chinese catfish exports dropped sharply, probably in reaction to more strict sanitary controls by US inspectors.

New standard for pangasius

On 29 April 2009 Global GAP, announced its new pangasius and tilapia standards, which were published after having been tested on fish farms. The development of the pangasius standard started in Viet Nam, the main producing country. Supported by German Technical Cooperation (GTZ), the working group presented a first draft proposal to GlobalGAP. The draft standard was subject to trial audits on six farms and stakeholder consultation.

The US International Trade Commission announced in June 2009 that it would keep the tariff on frozen fillets of Vietnamese catfish, known in the US as 'basa' and 'tra,' afraid that lifting the duty would harm the domestic catfish industry within a 'reasonably foreseeable time.' This decision did not come as a surprise. At present, Vietnamese exporters are more concerned with an upcoming decision as to whether to reclassify basa and tra as catfish under the US farm bill. This would mean more severe testing for antibiotics.

Prices of pangasius likely to increase further

The decline in production of pangasius in Viet Nam will result in a substantial shortages in raw material, and , at least in the near future, a substantial increase in price. The economic crisis in Spain, which is having negative implications for many other fish species, will result in more demand for pangasius, well known as a relatively cheap fish. In the US market, the situation might become difficult if basa and tra were classified as catfish.

July 2009