Introduction

After a prolonged phase of strong supplies, the increased demand around Christmas, coupled with the bad weather, resulted in a decline in salmon supplies. Therefore, prices picked up between mid-December and mid-January. However, towards the end of January, supplies of Norwegian salmon started to increase once again against a diminishing demand, thus leading prices to fall by 10 percent. At the time of the preparation of this report (mid-February 2008), prices were still declining.

On the institutional side, on 15 January 2008 the WTO Dispute Settlement Body (DSB) adopted the report of the panel that had examined Norway's complaint against the EU titled “European Communities — Anti-dumping measure on farmed salmon from Norway” (DS337). The panel raised a number of questions about the procedures and criteria used by the EU to justify the imposition of the Minimum Import Price (MIP) on Norwegian salmon, but at the same time it rejected the Norwegian call for an end to the MIP. Norway welcomed the report, requesting the EU to lift the MIP anyway. In response, the EU accepted the recommendations of the panel, adding that it would examine them when implementing the ruling, but at the same time it confirmed its intention to keep the MIP in place.

For more information on the EU-Norway farmed salmon dispute, please read: WTO News.

The news that the EU was not appealing the WTO finding would have normally led to an increase in the value of Norwegian salmon companies on the stock exchange. However, the value of salmon companies’ shares fell heavily, due to:

- the general negative trend of the international stock market;

- the bleak situation of global salmon markets, with falling prices and diseases affecting producers in Chile some of which are owned by Norwegian companies.

In January-December 2007, the EU imported 509 300 tonnes of salmon (live weight equivalent) from Norway, a 16.1 percent increase from 2006. In January 2008, the EU imported 38 600 tonnes of salmon from Norway, a 13.7 percent increase compared with January 2007. Despite the high volumes of salmon imported, prices remained low throughout the year due to the aforementioned excess of supply. In fact, unit values of Norwegian exports to the EU dropped from NOK29.624 (EUR3.60) in 2006 to NOK24.945 (EUR3.13) in 2007.

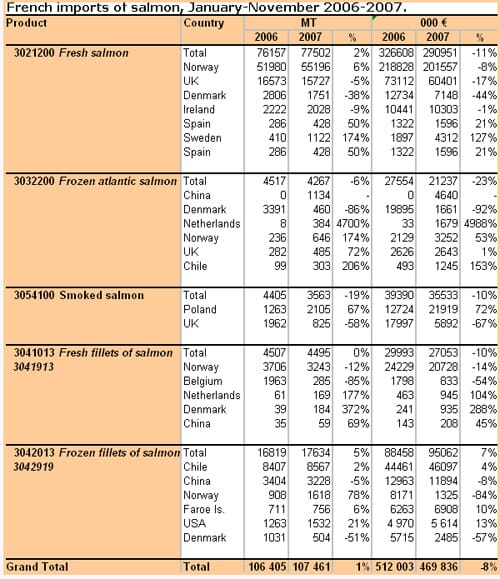

France

French imports of salmon increased from 106 400 tonnes, EUR512 million, in January-November 2006, to 107 500 tonnes, EUR469.8 million in January-November 2007. Due to the generalised decline of farmed salmon prices, imports of salmon became less expensive in terms of unit values, e.g. from EUR4.81/kg in January-November 2006 to EUR4.37/kg in January-November 2007. French salmon imports are dominated by fresh product from Norway, representing 51 percent of total French salmon imports in terms of quantity and 43 percent in terms of value. Besides the traditional suppliers such as Norway, the United Kingdom and Chile, China is emerging as an exporter of frozen salmon fillets (3 200 tonnes) and frozen Atlantic salmon (1 100 tonnes).

According to French industry sources, the distinction between products bearing quality labels such as Label Rouge and those for the mass market will become increasingly marked. Therefore, processors wanting to buy high quality salmon will have to get used to paying higher prices.

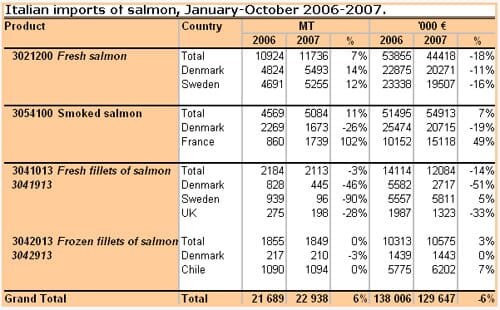

Italy

Italian import volumes of salmon increased from 21 700 tonnes in January-October 2006, EUR138 million, to 22 900 tonnes, but with falling prices, import volumes declined to EUR129.7 million, for January-October 2007. Imports of fresh salmon from Norway through Denmark and Sweden represented 47 percent of total Italian salmon imports in quantity and 31 percent of imports in value terms. Among the other suppliers, Chile is emerging as an exporter of frozen fillets of salmon (1 100 tonnes in January-October 2007), whilst France supplied Italy with 1 700 tonnes of smoked salmon in the same period.

Imports of smoked salmon are also quite significant, totalling 5 100 tonnes, equivalent to EUR54.9 million. The main suppliers are France and Denmark although the raw material is mostly Norwegian.

Outlook

According to statistics from the Norwegian Seafood Federation (FHL), between 2006 and 2008, Norwegian salmon prices have swung between NOK 19 (EUR2.35) and NOK 44 (EUR5.46). Unfortunately, industry consolidation in Norway did not result in price stabilization as expected. In fact, the salmon industry entails a biological production process which takes considerable time between the decision to produce salmon and the marketing of the final product. Therefore, salmon prices (and, as a consequence, salmon company shares) remain influenced by the market situation of the moment. In order to stabilize the salmon market, the Norwegian salmon industry is trying to achieve increased price predictability.

According to Professor Frank Asche from Stavanger University, quoted by www.intrafish.com, the only effective means to stop the cyclical trends of the salmon market is the futures’ market. “Futures” are standardized, transferable, exchange-traded contracts requiring the delivery of a commodity at a specified price, on a specified future date, with an obligation to buy. Prof. Asche added that if a contract can tell what the price would be in two years’ time, then production might be adapted to the market, leaving room for production increases in times of high demand.

News

Alaska firm rolls out new salmon wrap (19 February 2008). Alaska-based Taco Loco on Monday rolled out its new Alaska salmon wrap, a product the company said it took three years to develop. According to the owners of Taco Loco, the wrap meets growing demand for healthy entree alternatives at restaurants, retail outlets and institutional catering facilities. The product features wild salmon flavoured with a mild red chilli sauce. Taco-Loco received assistance from the Alaska Fish Marketing Board in 2006 to develop the product line (source: INTRAFISH).

Report: global salmon stocks at risk (12 February 2008). A new report is blaming salmon farms for destroying wild fish stocks. The paper, in the peer-reviewed journal, the Public Library of Science Biology, says sea lice, interbreeding escaped fish and parasites from farmed salmon are decimating wild salmon. In the report, the late Ransom Myers (a world-renowned fisheries biologist) and Jennifer Ford, marine issues co-ordinator with Halifax's Ecology Action Centre, compared the survival of salmon and trout that swam past salmon farms early in their life cycles with those that weren't exposed to aquaculture operations. Myers and Ford concluded that wild salmon exposed to farming operations experienced a decline of more than 50 per cent. However, the Canadian Department of Fisheries and Oceans (DFO) replied that there is little evidence to support the suggestion that the presence of salmon farms increases the risk of disease in wild stocks (sources: INTRAFISH).

Drug resistant lice can be a disaster (22 January 2008). There are reasons to believe that salmon lice in some parts of Norway are becoming resistant to the main oral anti-lice drug, Slice® (emamectin benzoate), reports the Norwegian net site http://www.kyst.no. The drug has been used on a couple of occasions lately without giving the expected results. A representative from Schering Plough, the company that developed Slice replied that at least once, underestimation of biomass during the de-licing had been the reason. This resulted in a very small amount of Slice being used. In another salmon farm the drug worked well in one pen, but not in others, which should not be interpreted as a sign of resistance. The same source added that a low effect could also be due to low appetite in salmon infected with IPN (infected pancreatic necrosis) virus. But it is known that salmon lice in Chile have developed resistance. Therefore, lice from the suspected sites in Norway are now being grown in a laboratory, and they will be tested for resistance when they reach what the scientists call a pre-adult stage (source: FIS).

February 2008