Report Highlights

Japan's domestic fishery sector continues to decline due to faltering domestic fish resources and industry population. Domestic production of seawater fishery and culture has been decreasing every year and it was 5.6 million metric tons (mmt) in 2006, down 1.5% or 83 mmt from the previous year. Although the import value increased 2.3%, import volume decreased 5.7% in 2006. Japan is still the world's largest importer (when EU countries are disaggregated)[F1] of fishery products but it’s being overtaken by other countries with growing demand and due to Japan's growing preference for meat over fish.

Production

Japan’s fishery and aquaculture production was 5,669,000 metric tons in 2006, a decrease of 96,000 metric tons (1.7%) from the previous year. Production from fishery and sea culture was 5,586,000 metric tons. Although anchovy production increased, sagittated (aka loligo) calamari and bonito decreased so total production decreased.

For inland water fishery and culture, fish catches and production were 83,000 tons in 2006. Eel is becoming more important in this category, as imports from China have faced difficulties with Japan’s MRL Positive List. Trout, sweetfish (Ayu) and inland water carp culture decreased which in total resulted in a decline of 549 metric tons (1.3[F2]% decreased from previous year). MAFF now excludes catch by sport fishing so the survey only covers catch for commercial purposes, magnifying the appearance of a decline in 2006.

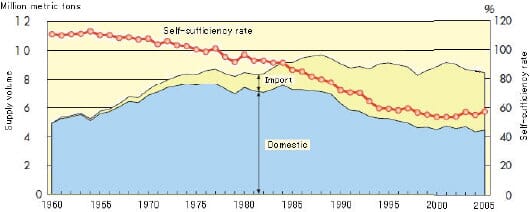

The fishery products self-sufficiency rate peaked at 113% in 1964 and it has been falling since. It was 57% in 2005 up 2% up from the previous year but this increase is misleading. Rather than reflecting an increase in production the self-sufficiency rate increases due to a decline in consumption. Consumption of edible fishery products has been decreasing dramatically from 40.2kg/person-year in 2001 to 34.4kg/person-year in 2005. Several factors explain this situation. In particular, the younger generation is turning more and more away from fish. They prefer new foods (e.g. Western, meatbased foods) and also are turned off by the effort they believe is involved in preparing fish.

The 1.7% decrease in production reflects a downward trend in the fisheries sector in Japan, mirroring the overall decline in Japanese agriculture. The number of seawater fisheries and aquaculture operations declined by 4% in 2005 from the previous year to 125,000, of which 95% are coastal fishery operations mainly run by family labor. There are 7000 small and medium-scale fishery management entities using hired labor. There are only 112 large-scale fishery management entities, those with a total of 1000 tons or more of motor-power vessels[F3].

The number of fishery workers is on the decline, too. In 2006 there were 212,470 fishery workers, a declined of 8,700 (4.4%) from the previous year and down 30% from 1995. The decline is due mainly to closures and the overall drop in catch and reduction in business and also due to the retirement of aging fishermen. The percentage of male fishery workers 65 or older is 36.4% up 0.7 % over previous year.

Similarly, the fisheries cooperatives are also threatened by the recent deterioration of the fishing industry. Japan had 2,377 fisheries cooperatives in 2005. Three quarters of these are running a deficit and efforts are underway to merge in order to improve their business infrastructure. 149 fishery cooperative associations were involved in mergers last year, the highest number since 1967. Nevertheless, that falls short of the aim to merge[F4] 250 fishery cooperatives by an end of this fiscal year (March 2007) when the special merger promotion expires.

More than the half of the fishery resources of the waters surrounding Japan are facing seriously low levels, including Pollack, Atka mackerel, squid and sardines (please refer GAIN JA7032 for details http://www.fas.usda.gov/gainfiles/200705/146281152.pdf) The government’s resource recovery plan includes reducing the total allowable catch. As of March 2007, there were 51 resource recovery plans in the operational of planning stage encompassing 76 different fish stocks.

In addition to the economic reasons for the decline in the vitality of fishing villages there is also the overall social trend away from the regions and toward big cities. Small towns and fishing villages all over Japan are suffering as a result of the outflow of young adults. As a result, the remaining workers are of advanced age. For example, the number of male workers[F5] over 60 years old in Japan was 83,470, or 46.9% of total workers. The Fisherman Recruitment Center gives information about job offers to employment candidates and six months training for youth without fishing experience. Despite those efforts, the downward trend will continue because the number of the new employees is only around 1,500 a year. It is a real challenge to secure a young labor force.

Import Market

Japanese fishery products imports in 2006 decreased 5.7% by volume[F6] over the previous year to 3.15mmt. Meanwhile, the import value has been increasing and went up 2.3% in 2006. Japanese fishery products imports accounted for $14.83 billion dollars, or 19%, of world fisheries trade in 2004[F7] (the equivalent of 3.5 mmt). However, consumption of fishery products stalled in the mid 1980’s and more recently has been on the decline. On the other hand, the consumption of fishery products is on the rise elsewhere in the world due largely to positive health attributes associated with fish. As a result, the Japanese share of world imports has fallen from a peak of 16% in 1995 [F8]to less than 12% in 2004 (in volume terms).

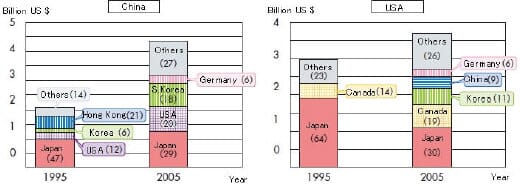

Japan’s major imported fishery products are shrimp, tuna and bonito, salmon and trout, crab, cod and Pollock roes, processed shrimp, and processed eels. These items account for about half of total fishery product imports. China has been the largest fishery products supplier in volume and value since 1998. The volume of imports decreased 190,000 metric tons (5.7%) but the value increased 38 billion yen (2.3%) in 2006 over the previous year. Fishery products imports from the United States were 152 billion yen (8.9% share) in 2006 and the U.S. ranked second after China (382 billion yen, 22.4% share) as the biggest supplier. Japan is still the largest importer for the United States. However its share of exports has shifted from 64% in 1995 down to 30% in 2005. This reflects growing competition from the US and third country consumers. Japan is having to compete with other buyers for its seafood.

In the case of Chinese and US exports to Japan versus the rest of the world, the following graphs show the percentage shift in volume away from Japan towards the US, Korea and “Others” (most likely Western Europe).

Destination change for export of fishery products

Numbers in parentheses show percentage of each imprting country

Policy

Japan updated their Fishery Master Plan in March 2007. The plan is a concrete game plan based on the Fishery Basic Act established in 2001. It was devised for the first time in March, 2002, and it was revised for the first time in 2007. In the fishery white paper, reference to the plan is made at the beginning, and it is the main part of an important fishery policy in Japan. There are six key points in the new plan, as follows:

- Promote resource recovery and sustainable management of marine resources that are at a low level.

- Cultivate and ensure that management entities are globally competitive. Establish proactive fishery employment structure ensure income stability.

- In order to secure the stable supply of fishery products, implement measures for processing, distribution and consumption

- Develop and spread new technology for the future of fisheries.

- Carry out overall maintenance of fishing ports, fishing grounds, and fishing villages. Ensure the “multifunctionality” of fisheries and fishing villages is supported.

- Reorganize and streamline [F9]fishery cooperatives.

Point[F10] number two on competitiveness is a key. Much of the fishing fleet is old. This plan aims to upgrade the fleet, making it more energy and labor efficient. Fishermen would be supported via income stabilization measures.

Consumption

The volume of fishery products for domestic consumption was 10.27mmt in 2006, a decrease of 2% from the previous year. Out of these, the ratio for food was 7.82[F11] mmt also down 2% from the previous year which accounts for 61.2kg (gross food basis) per person annually. This is 34.4kg per person annually when inedible parts are excluded, such as heads, guts, fins and bones. Again, the major trend in consumption patterns is a shift away from fish products and toward more meat and dairy.

Self-sufficiency rate and supply volume change of fishery products for food

The annual report of the family income and expenditure survey explains trends in fresh meat and fish purchases. The purchase volume of fresh meat doubled from 6kg per person annually in 1965 to 12kg in 1979. Then it stabilized at 12kg and only moved upward slightly to 12.6 kg in 2005. In contrast, the purchase volume of fresh fish has been decreasing gradually from around 16kg per person annually in 1965 down virtually on par with fresh meat at 12.7 kg in 2005. Fish volume is likely to be surpassed by meat in the near future.

Note: glossary

Fresh fish: Fishery products with no major processing for preservation (dryness, preserving in salt, etc.) carried out. However, the minimum processing of freezing, washing, cutting, removal of discard, etc. is included.

Fresh meat: Included products with minimum processing such as chopping and slicing. Also included guts and frozen products.

Purchase of Volume of Fresh Fish and Fresh Meat

Purchase of Volume of Fresh Fish and Fresh MeatMarketing

In recent years, declining catches and sales have been continuing at small scale wholesale fisheries markets. As result, price of fishery products has been unstable due to weak price formation. To improve this situation, GOJ laid down a “Policy to consolidate and improvement of business of fishery market” in March 2001. Each prefectural government has been working to integrate markets. However, agreement on consolidation by concerned parties has been difficult to achieve so consolidation is moving slower than planned. The target number is 500 markets by 2010 but there are still 815 markets as of May 2006.

Fishery products labeling was introduced after the Japan Agricultural Standards (JAS) Law was revised in 1999. Country of origin or local origin labeling started from July 1, 2000 for fresh fisheries products. It is required to show “Name” and “land of origin”. As for processed fisheries products, “name”, “material”, “use-by date” and “storage condition” were required to be shown as of April 1, 2000. Material place of origin has been required for six fisheries processed food items such as dried Japanese horse mackerel, salted mackerel, dry brown seaweed, salted brown seaweed, shavings of dried bonito and broiled eel. In addition to that, another six fisheries processed food product groups such as lightly-dried, salted, seasoned, boiled or steamed, lightly-roasted and batter coated is required to show material place of origin from October, 2006. Those items and product groups are not heavily imported from the United States. MAFF has established guidelines for the labeling of place of origin of ingredients used in the food service industry in July, 2005. Although, this is a guideline and is not mandatory, 84% of consumers surveyed answered that should be necessary.

Japanese trademark law was revised and became effective from April 2006. Local community trademarks can be registered if the trademark combining regional name and product name achieve name recognition in several prefectural areas. This system created great interest in its potential use to help strengthening regional vitality and competitiveness. There are 177 trademarks registered, 18 of which are fishery products.

New Market Opportunities

Last year fishery products with a “Marine Eco Label” started to appear in a handful of Japanese supermarkets. The label aims to assure shoppers that the fish were caught in an ecological and sustainable manner. In 2006, Kamewa Shoten, a middle trader in Tokyo’s famous Tsukiji market, received the first Marine Steward Ship Council (MSC), “Chain of Custody (COC) Certification” in Japan for its Alaska salmon and Black Cod imports. The large supermarket chain, AEON, started to sell MSC labeled fishery products in October 2006. The Japan Fisheries Association (JFA) announced establishment of a “Marine Eco Label Japan” (MEL) at the Japan International Seafood Show. Details have not been decided yet but they aim to start in 2007.

As a result of these combined factors and as a result of the publicity surrounding sanctions on bluefin tuna catch due to overfishing (see GAIN JA6056 http://www.fas.usda.gov/gainfiles/200705/146281152.pdf), consumers will have the opportunity to learn more about marine eco label and Post expects that awareness of the issue of ecological and sustainable fishery practices will increase.

Market Access Barriers

The food sanitation law was revised in 2003, and the so-called “Positive List” system of regulating Maximum Residue Limits (MRL) became effective in May, 2006. This system regulates MRLs for agro chemicals, animal drugs, and feed additives that are used domestically and internationally. A single violation of an MRL stops distribution of the food and leads to 50% testing of all like product imported from the country in violation. Please see details of this system http://www.fas.usda.gov/gainfiles/200602/146176749.pdf and also new related reports are continuously uploading at USDA attaché report website:

http://www.fas.usda.gov/scriptsw/AttacheRep/default.asp, and search with Commodities* Sanitary/Phytosanitary/Food Safety and Country: Japan.

The Japanese public is highly sensitized to MRL violations and it can spell real hardships for the offending industry and country. For example, Japan, like the U.S., has faced difficulties with fish and shellfish exceeding certain MRLs. In the case of eel since it is a major food product the impact of a finding was significant for summer eel sales in Japan. In addition, soon after that incident a very small quantity of a metabolite of malachite green, which is not a human health concern, was detected on imported grilled eel in Gumma Prefecture. A large frozen food maker and department stores stopped sales of this imported eel. According to the association, due to these incidents, the sales volume in July was 10 to 20 percent of the average year.

A similar incident happened last December when Japan had a major outbreak of infectious gastroenteritis caused by norovirus.. As a result, consumers avoided purchasing and consuming oysters and the fall in demand led to a price decline. The price of an oyster in Tokyo Metropolitan Central Wholesale Market of January, 2007 slumped around 76%, the volume around 68% compared to the same month last year.

Further Reading

|

|

- You can view the full report, including tables, by clicking here. |

To view our complete list of 2007 Fishery Products Annual reports, please click here

October 2007