This new sanitary problem is changing the short term business scenario for some companies which are already making adjustments in their operations. Some operators say that the industry is going through its first major setback, as experienced by other countries, but expect it to overcome this situation and become stronger.

Growing exports in 2007

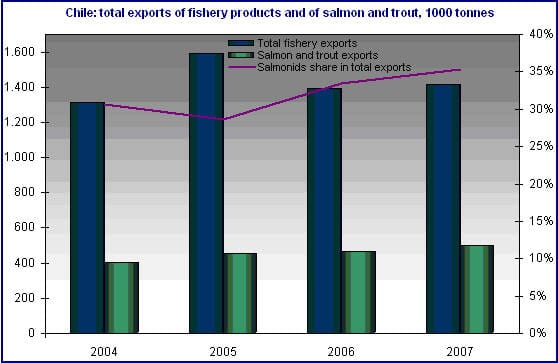

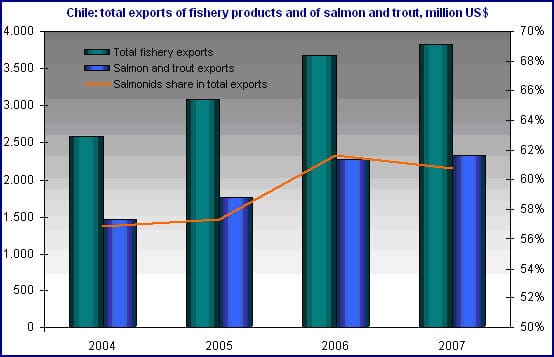

Chilean exports of salmon and trout during 2007 totalled 498 360 tonnes worth US$ 2,326 millions. This represents a seven per cent growth rate in terms of volume and a two per cent increase in terms of value. These variations break a trend of two digits growth rates in the last four years in the value of exports. Salmon and trout accounted for 61 per cent of the income generated by total Chilean fishery exports, and for 35 per cent of the exported volume. The share of salmon and trout in total exports can be seen in the graphs below. Meanwhile, in 2006, the salmonids sector accounted for 62 per cent and 33 per cent of total exports in terms of value and volume respectively. This slowdown in export activity was against all forecasts for 2007, and one of the main causes was the series of disease problems faced by this industry.

Also, during 2007 total Chilean exports grew 15 per cent reaching US$ 65,484 million, consequently, salmon and trout were 4 per cent of total national exports last year. Nevertheless the slowdown in trade, Chilean exports of salmon and trout have grown since 2001, 62.9 per cent in terms of quantity, and 140 per cent in terms of value.

Production pushed up by trout, and affected by several diseases

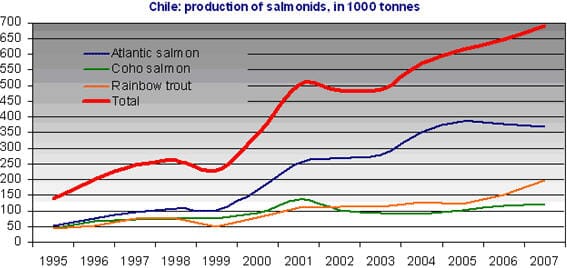

Total salmonid production in 2007 was 688 536 tonnes, which represents a six per cent increase compared to the previous year. The main species is Atlantic salmon (Salmo salar), which accounted for 54 per cent of total production. The second most important species is rainbow trout (Onchorhynchus mykiss), with a 29 per cent share in production. The third species in importance during 2007 was coho salmon (Onchorhynchus kisutch) with 17 per cent of production. However, production trends for the different species are uneven. Production of Atlantic salmon fell for the second consecutive year, -1.5 per cent, after falling 2.4 per cent in 2006 following seven years of sustained growth. On the other hand, rainbow trout had a remarkable 30 per cent growth, and this species is mainly responsible for the total growth in production during 2007.

During 2007, several diseases affected the salmon industry in Chile. In previous years, the harvest had been affected by the SRS (Salmon Rickettsial Septicemia) and the IPN (Infectious Pancreatic Necrosis), among others. In 2007, there was a spreading of the Caligus or sea lice problem. And in the second half of the year, there was a series of outbreaks of the ISA (Infectious Salmon Anemia) virus, causing big mortalities and concern about the sanitary status of salmon production. The virus was first detected in the X Region, where most of the production takes place. The disease appeared in at least 18 production centers, and about 40 others were under suspicion of being infected. The first notification of the presence of the virus was on 7 July in a farm owned by Marine Harvest, which so far has been the most affected company. This disease had previously appeared in other salmon producing countries but had never been present in Chilean salmon. Several measures were taken to stop the virus from spreading, from quarantines to the complete slaughtering of infected crops. Some companies were even planning to start moving south to the XI Region, an up to recently ISA free Region. This Region has already divided its waters into zones relating to tourist activities, salmon farms, mussel farms, and other activities. But recently an outbreak was detected in two farms in this Region. In order to keep the area free of the infection, the whole population in that farm was slaughtered. On the other hand, the six most important salmon producers (Marine Harvest Chile, Aqua Chile, Camanchaca, Pesquera Los Fiordos and Mainstream Chile) started sharing information and working jointly in what is known as the “G6”, in order to take joint measures to improve the sanitary conditions and reduce the incidence of the various diseases. The measures proposed include periods of rest for the crop areas, minimum distance between farms, biosecurity and sanitary surveillance. On the other hand, there was a recent management change in the National Fisheries Service. Some operators see this as an outcome of the recent election process, but others think that the change was due to some declarations by the former Director, which were not appreciated by salmon companies. The latter have also stated that the measures taken by the Service were insufficient. In the future, this Service will have to implement several measures to assure that the conditions which eased the spread of the diseases (such as extreme proximity among farms, high density of crops, and the lack of a defined policy of rotation and fallowing of sites) are not repeated.

It was just a matter of time before the various disease problems started to affect the profitability of industry producers. The first one to announce big changes in its strategy was Marine Harvest. This is the main salmon producer in Chile, owned by the Norwegian group, Pan Fish. Marine Harvest accounted in 2007 for 13.9 per cent of the export revenues for Chilean salmonids. Also, it was the company with the highest number of farm affected by the ISA virus. This had a direct impact on its business results, and in the fourth quarter, it showed write-off losses of US$ 76 million. This resulted in a series of management measures to put the company back on a sound financial footing. For 2008, it announced a reduction in volumes (the estimated harvest for 2008 is 60 000 tonnes of Atlantic salmon and 11 000 tonnes of rainbow trout), as well as a reduction in personnel, of about 25 per cent, which means layoffs of about 1 000 workers. Also, there was a possibility of moving some of its centers south. The beginning of the staff cuts is scheduled for March to be completed by June. The workers’ unions were negotiating alternatives to reduce the number of layoffs, such as relocating job positions to the new farms in the event of new operations in the Southern Regions, and also government subsidies were requested to help those workers which remain unemployed. Nevertheless, the company management has stated that it does not intend to leave the country, but rather to strengthen the financial situation in order to recover from these setbacks.

Labour conflicts and publicity campaigns

A further recent issue was an increase in labour disputes. The salmon sector employs about 53,000 people in Chile. Several negotiations to improve the level of salaries and work conditions were successful, but in the case of a plant owned by Aqua Chile, the failure to reach an agreement was evident when workers went on strike and took control of the plant. This situation lasted for almost a month with the possibility of final closure of the plant raised by management. Eventually, occupation of the plant ended and negotiations regarding the level of salaries were restarted. The incident was, however, symptomatic of the general situation in the industry. According to a brief prepared by the NGO, Ecoceanos, and using information from the National Work Direction, the industry is affected by a series of problems, such as lack of adherence to regulations including weak hygiene and security standards and poor safety conditions for working at sea, with an important number of fatal accidents among divers (eight since 2005). It is worth noting that the Chilean salmon industry is almost twenty times more labour intensive than the Norwegian industry.

The issue of labour conditions is part of a campaign started by some NGO’s concerning the salmon industry. This campaign focuses also on the environmental impact of salmonids aquaculture. Under the slogan “with no fear, against the current”, it targets environmental impact as well as labour conditions. It is based on poster ads as illustrated above. According to the NGO’s responsible for the campaign, this sector has the second highest accident ratio in the country and salaries have a highly variable component being significantly affected by changes in the level of production.

Regarding environmental issues, they highlight the negative impact on other species and the conversion rate relating to production. Those responsible for the campaign state that they are aware of all the benefits of the industry as a source of employment and activity, but they consider that other important issues have been ignored so far. More information can be obtained from the campaign website, www.contralacorriente.cl.

On the other hand, the Association of the Salmon Industry (SalmonChile), has also started a campaign under the slogan “we feed the world, we feed our south”, highlighting the commitment of the association to several social objectives, such as libraries for schools, cultural activities, sponsoring of sports. It also highlights the importance of the sector regarding economic growth, and the social impact of a dynamic activity, as well as the creation of associated activities such as transport, communications, food and technology. This campaign tries to focus on the social commitment of the salmon companies, and their contribution to the towns and cities in areas where they are based. More information can be found on the association’s website, www.salmonchile.cl

Also, another economic group that has shown its concern towards the salmon sector is that of tourist operators. They expressed concern regarding the possibility of the industry moving south, an area with an important tourist activity, and the potential impact it would have, not only from the establishment of farms, but also from the effects of transportation and plant operations on towns and cities.

Main exported species and products

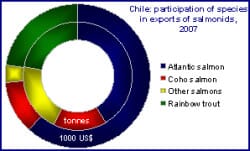

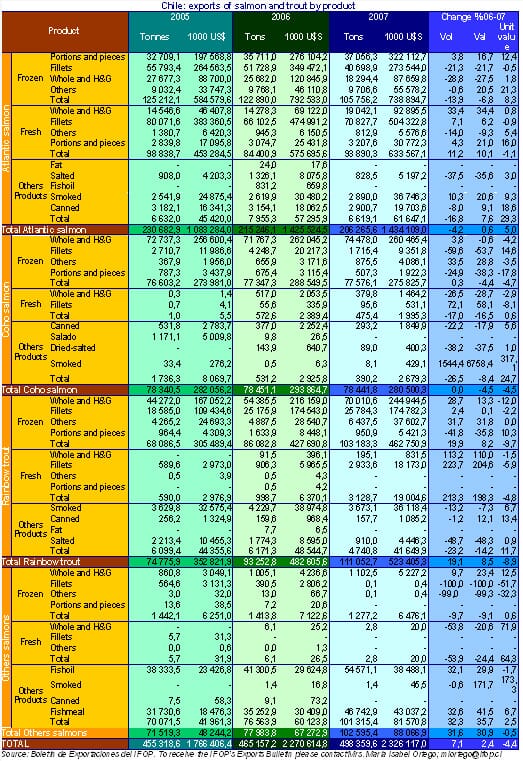

During 2007, Atlantic salmon remained the leading export species, with 206 266 tonnes worth US$ 1,434 million, which represents a share of 41 per cent and 62 per cent in salmonid export volumes and values respectively. The second most important species is rainbow trout, and with 111,053 tonnes worth US$ 523.4 million, it accounted for 22 per cent of export volumes and 23 per cent of revenues. The other significant share is accounted by coho salmon, with a 16 per cent and 12 per cent share respectively in export volumes and values (78,442 tonnes; US$ 280.5 million). The “other salmon products”, category which includes both king salmon, as well as products with no specified species, such as fishmeal and fish oil, was responsible for 21 per cent of salmonid export volumes and four per cent of the exported value.

It interesting to note that both Atlantic and coho salmon fell in terms of total salmonid export share (-2 per cent in volume and -7 per cent in value), while rainbow trout increased its share by 11 per cent in volume and 6 per cent in value. In terms of total salmonid exports, trout was a key category behind the increase in export values. While exports of Atlantic salmon grew by just US$ 8.6 million and coho salmon exports fell by US$ 13.4 million, exports of trout grew by US$ 40.8 million and “other salmon products” by US$ 20.8 million with total exports increasing by US$ 56.8 million. The trend in terms of volume is a little different, with the most important variation shown by “other salmon products” (+24,614 tonnes), followed by rainbow trout (+17,800 tonnes) while the variation in total export volumes was +33 423 tonnes.

Regarding the different product categories, frozen products accounted for 64 per cent of the total value and 58 per cent of the volume of salmonid exports during 2007 (US$ 1,484 million; 287,797 tonnes). The second category was fresh products, with a share of 28 per cent in value and 20 per cent in volume terms (US$ 654.6 million; 97,497 tonnes). Smoked products register much lower shares (3 per cent of total values and 1 per cent of total volumes) along with fishmeal (two per cent; nine per cent) and fish oil (two per cent; 11 per cent). In terms of individual product groups, the number one export item is fillets. Fillets account for 44 per cent of total export values, and 29 per cent of total volumes (US$ 1,025.6 million; 146,511 tonnes), followed by whole and H&G with US$ 694.5 million and 183,621 tonnes (30 per cent and 37 per cent respectively), and thirdly, portions and pieces with US$ 399.8 million and 46,677 tonnes (17 per cent and nine per cent respectively of total exports).

Compared to 2006, exports of fillets fell 5 per cent in terms of both value and volume. On the other hand, whole and H&G exports grew 3 per cent in terms of value and nine per cent in volume terms. Portions and pieces fell in terms of volume (-2 per cent), but grew 12 per cent in terms of value, which implies an increase of 14 per cent in the unit value of these products. It is worth highlighting the remarkable growth of exports of fishmeal, both in terms of volume and value (+33 per cent and +42 per cent respectively). Besides the higher price of this commodity in world markets, it is possible that there has been an increase in the output of salmon based fishmeal, as an alternative use for disease risk salmon.

Inside the fillets category, the fresh fillet sub-category is the most important with a volume of trade of 73,857 tonnes worth US$ 523 million. Sales of this line of production grew 10 per cent in terms of volume and eight per cent in terms of value compared to the previous year. But at this level of detail in export figures, the most important category during 2007 was frozen whole and H&G, which accounted for 33 per cent of total volume and 26 per cent of total value with 163 886 tonnes, worth US$ 598.3 million. However this category grew only in terms of volume, with export unit values falling by 7.5 per cent.

When we take into consideration the different species, the main traded product in terms of value is fresh fillets of Atlantic salmon. During 2007, as can be seen in the following chart, sales reached 70 828 tonnes worth US$ 504.3 million, which represents an increase of seven per cent in terms of volume and +6 per cent in terms of value compared to 2006. This also shows that export unit values of fresh Atlantic salmon fillets fell by one per cent. In second place (regarding the value of exports) is placed frozen pieces and portions of Atlantic salmon, with US$ 322.1 million and 37 056 tonnes. In terms of volume, the most exported product was frozen whole and H&G coho salmon with 74,478 tonnes, worth US$ 260.5 million. Exports of frozen whole and H&G rainbow trout make up the most important category for this species, and takes the third place in terms of overall salmonid volume exports and fifth in terms of value, with 70,011 tonnes worth US$ 244.9 million.

Looking at unit values, the strongest increase among the most significant categories was shown by frozen pieces and portions of Atlantic salmon, which grew 12.4 per cent during 2007. Most product categories followed the general trend of a decreasing unit value. As for species, Atlantic salmon was the only one which did not show an overall reduction in unit value (+4 per cent).

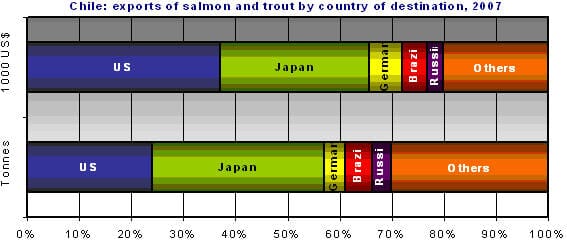

Export markets remained highly concentrated during 2007

During 2007, the main destination for Chilean salmonid exports in terms of value was the US market, worth US$ 863.3 million, it accounted for 37.1 per cent of total sales to foreign markets. In terms of volume, the US market is placed second with 119,218.3 tonnes and a share of 23.9 per cent in total exported volumes. Atlantic salmon is the main species exported to this nation, accounting for 90 per cent of sales in terms of quantity and 95.3 per cent of the exported value. The most important product is Atlantic salmon fresh fillets with 63 per cent and 58 per cent of total volume and value respectively of Chilean salmonids sold to the USA (67,165 tonnes; US$ 479.3 million). The second most important product exported to this country is frozen portions and pieces, with 16,801.1 tonnes worth US$ 158.9 million (16 per cent and 19 per cent respectively of total volumes and values).

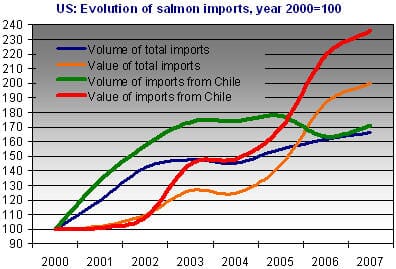

Chile has become the top supplier of salmon to the US market, according to figures provided by the NMFS. It is interesting to note that imports from Chile have managed to grow above the average for total imports. It is also noteworthy that while there has been a reduction in the traded volume from Chile to the USA in recent years, value has increased continuously. Since 2000, value has more than doubled, and considering that between 2000 and 2007 the imported volume “only” grew 71 per cent, the unit value of imports of salmon from Chile to the USA grew by 38 per cent. In 2007, the Chilean share in total US imports of salmon was 44 per cent in terms of both volume and value.

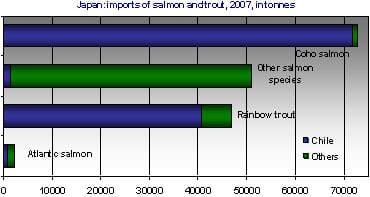

Japan is the second market in importance for Chilean salmonids in terms of value, and the main one in terms of volume, with 2007 purchases of 164 814 tonnes worth U$S 663.6 million. Compared to 2006, this represents a fall of 1 per cent and 8 per cent respectively. The main product exported from Chile to this country is rainbow trout, both in terms of volume and value, which accounts for 43 per cent of the exported volume and 54 per cent of the exported value (70,488 tonnes worth U$S 360.3 million). The second most important product sold is coho salmon, with a share of 41 per cent and 36 per cent in exported volume and value respectively. Chile is the most important supplier of these products to the Japanese market, accounting for 66 per cent of total imports, according to Globefish figures. As for rainbow trout and coho salmon, Chile enjoys an almost monopoly position as supplier, being responsible for 87 per cent and 99 per cent of total supplies in 2007. The most important product sold to this country is frozen whole and H&G coho salmon, with 66 036 tonnes worth US$ 229.3 million, followed by frozen fillets of rainbow trout (21,121 tonnes; US$ 145.3 million), and frozen whole and H&G trout (38,207 tonnes; US$ 134.4 million).

With much lower shares, the most significant export markets for Chilean salmonids are Germany (4 per cent by volume and 6 per cent by value), Brazil (five per cent, value and volume) and Russia (four per cent and three per cent respectively). In the case of Germany and Brazil, the most important species traded is Atlantic salmon, which represents respectively 95 per cent and 84 per cent of volume, and 98 per cent and 91 per cent of total value sold to each country. As for Russia, exports to which grew significantly, the most important species is rainbow trout, with 13,358 tonnes worth US$ 52.3 million. Altogether, these five countries, have maintained their total share in the value of Chilean exports of salmon and trout between 2006 and 2007 (almost 80 per cent).

Outlook: 2008 will provide several challenges for the salmon industry

During 2007 the Chilean salmon and trout production was hit by several disease problems, as well as by natural catastrophes, such as earthquakes and a tsunami in Region XI at the beginning of the year. These events had a serious impact in production. However, total production showed again a new increase, pushed by production of trout. The appearance of a new agent, the ISA virus, previously absent in Chilean salmon, has hit production strongly, and raised a number of issues for industry and state resolution. For the near future, it will be necessary to set new rules that help stop the ISA from spreading. This will imply, according to some operators, the development of vaccines, new rules regarding the distance between production sites, limitation on the densities in the different areas, a redistribution of production to new areas. One of the most important matters is a good level of cooperation between companies and government agencies, in order to have a quick response, both to outbreaks and to implement the new measures required. Some companies have already begun taking action; there has been a huge increase in applications to establish harvest centers in the southern Regions XI and XII. On the other hand, these series of problems have started to have an impact on corporate results. An example of this is Marine Harvest, which has already announced, as previously mentioned, a 25 per cent cut in its staff. This situation, is also affecting those businesses connected to the salmon industry, with some suppliers stating that there is already a cut in the level of investment with a slow down in their own activity. However, many other operators see the actual situation as the first setback in an industry that grew at remarkable rates in the last few years. They trust that the Chilean industry will, like Norway and Scotland, come out stronger, and see this situation as an opportunity to improve some problems the consequence of an extremely fast growth, such as the lack of planning regarding the requirements for the establishment of centers and for appropriate environmental and sanitary conditions.

This has also been a year of labour conflicts. Unions have managed in many cases to improve their salaries and labour conditions through negotiations with the companies, but in some other cases, agreements could not be reached, and conflict situations became evident. According to the General Manager of SalmonChile, Rodrigo Infante, labour conditions are improving. However, conflicts are expected to continue during 2008. Taking into consideration the campaigns taking place, as well as the statements by both union leaders and government authorities during the present year, salaries and labour conditions will probably remain issues of contention.

Regarding international conditions, this sector has faced an increase in operational costs due to the growth of fuel prices. Also while prices in international markets have not been strong, some analysts say that price falls would have been higher without Chile’s production difficulties. The sector has also been hit by the depreciation of the US dollar, which implies a reduction in the market price expressed in Chilean pesos. At the same time, some see in the sustained growth of some emerging economies, such as India, Brazil and China, new market opportunities, due to a growing demand for proteins. In addition, the government is trying to get better market access conditions to already existing markets, an example of this is the application which the authorities will present at the EU, to increase the duty free quota for smoked salmon, which is currently placed at 40 tonnes, and some industry operators state they would be in a position to export about 8,000 tonnes. After the 40 tonne quota is reached, Chilean products must pay a 15 per cent duty.

One matter that has been also highlighted is the need to increase the efficiency and competitiveness of the industry. Profitability is likely to be lower in the short term, so some initiatives are needed to improve efficiency, to reduce operational costs and to add more value to products. For the present however, environmental sustainability, labour conditions, value addition, new market opportunities and sanitary improvement are likely to be the key industry issues.

Report prepared by Javier López Ríos (INFOPESCA) © FAO GLOBEFISH 2008

April 2008