European imports of Alaska pollock fillets stable in 2007

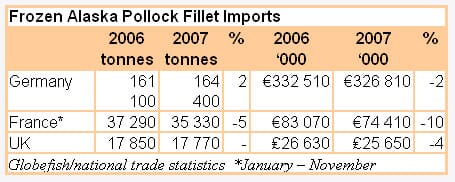

Demand remained firm and, with a relatively stable supply situation, European imports were largely in line with 2006 levels.

|

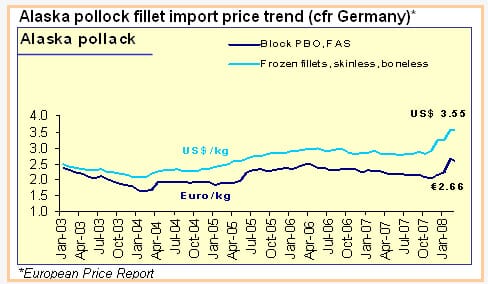

A relatively steady price trend during much of 2007 changed towards the end of the year as it became evident that a reduced US quota would be implemented during 2008. Dollar prices have maintained an upward trend during the first quarter of the current year.

Stronger US sales to Germany

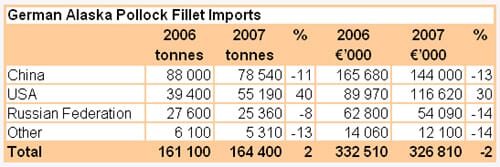

Germany, Europe’s leading Alaska pollock fillet importer, increased volume imports during 2007, modestly exceeding the record level set the previous year by 2 per cent. In value terms, imports fell slightly reflecting lower average euro prices for imports.

The stronger German volume imports were due to a 40 per cent jump in US supplies, an increase which followed an apparent switch from pollock surimi production to fillet production in North America during 2007. The US increase more than balanced volume declines from both China and the Russian Federation last year. Fillet volumes from the Russian Federation to the German market continue to decline with Russian suppliers now focusing more on h&g production for the Chinese re-processing sector. Between them, the three supplying countries continue to dominate the European pollock fillet market, accounting for 95 per cent of total German imports during 2007.

Increasing fillet production in the USA has allowed the country to increase its share of German imports from a quarter in 2006 to a third last year. In contrast, China’s share, which in recent years has increased to over a half of total volumes, fell below the 50 per cent mark during 2007. The long term decline in the Russian share has continued, down a tenth on the 2006 level to just over 15 per cent.

Marketing initiatives in France

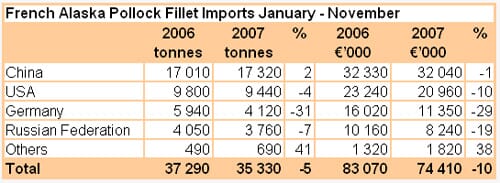

Following an increase in Alaska pollock imports during 2006, French imports stabilized around a slightly lower level in 2007. For the January – November period, total volumes fell five per cent, to 35 000 tonnes, compared to the same period in 2006. Chinese supplies, which account for about a half of total imports were largely stable while volumes from the USA, the second supplier, were down slightly to 9 400 tonnes. In contrast, a strong drop was registered for German supplies, over 30 per cent, while Russian supplies fell 7 per cent to less than 4 000 tonnes.

In line with developments in the German market, last year saw a fall in average French import prices in euro terms which implied a stronger value decline compared to volumes. For the eleven month period, average French import values fell five per cent to €2.11/kg.

At consumer level, the French market saw the appearance of Alaska pollock products with eco-labels during 2007. This development follows the certification by the Marine Stewardship Council (MSC) of Alaska’s pollock fishery. Market leaders in the French frozen fillet segment, Findus and Iglo, introduced a range of breaded pollock based products which carry the MSC label. The introduction of eco-label products by both companies can be seen as an attempt at product differentiation in a segment in which retail branded products account for a significant market share.

There have also been some eco-label initiatives at retailer level with Carrefour, Europe’s leading chain, launching an Alaska pollock fillet product under its own Agir Eco Planete brand and carrying the MSC label. The 1 kg pack was being promoted early in 2008 at €5, a price which compares with €3.65 for a 1 kg pack produced in China and selling in a competing hypermarket chain at the same time.

China increases share of UK imports

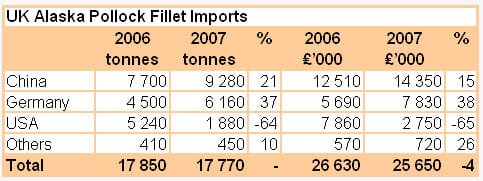

UK fillet imports during 2007 followed the relatively stable trends in Germany and France with volumes unchanged on the previous year at almost 18 000 tonnes. Import unit values also fell slightly (-3 per cent) in the UK with a decline in the sterling value of imports , -4 per cent to £25.7 million.

The overall stability in UK volume imports last year contrasted with some significant changes in import shares. As in France, China increased its share, the rate rising from 43 per cent in 2006 to 52 per cent last year. The US share, on the other hand, fell from almost 30 per cent to 10 per cent. This drop may be partly explained by re-exports of US fillets from Germany to the UK. German volumes increased in 2007 by 37 per cent to over 6 000 tonnes.

Stronger dollar prices in 2008

A drop of over a quarter in the US Alaska pollock quota to around one million tonnes this year is reflected in an increase in dollar prices for fillets in recent months. Indications* over the December – March period for skinless, boneless blocks of US origin point to a 12 per cent increase in cfr prices to around $2.70/kg.

The dollar weakness over the period implies a smaller increase in euro terms so demand for fillets should remain relatively buoyant over the coming months. Recent marketing initiatives such as the introduction of eco-labels for several Alaska pollock products in the French market will be followed with interest as producers and distributors look to add value to a product traditionally sold essentially on a price basis.

April 2008